Morning Star Candlestick Pattern

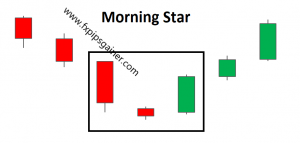

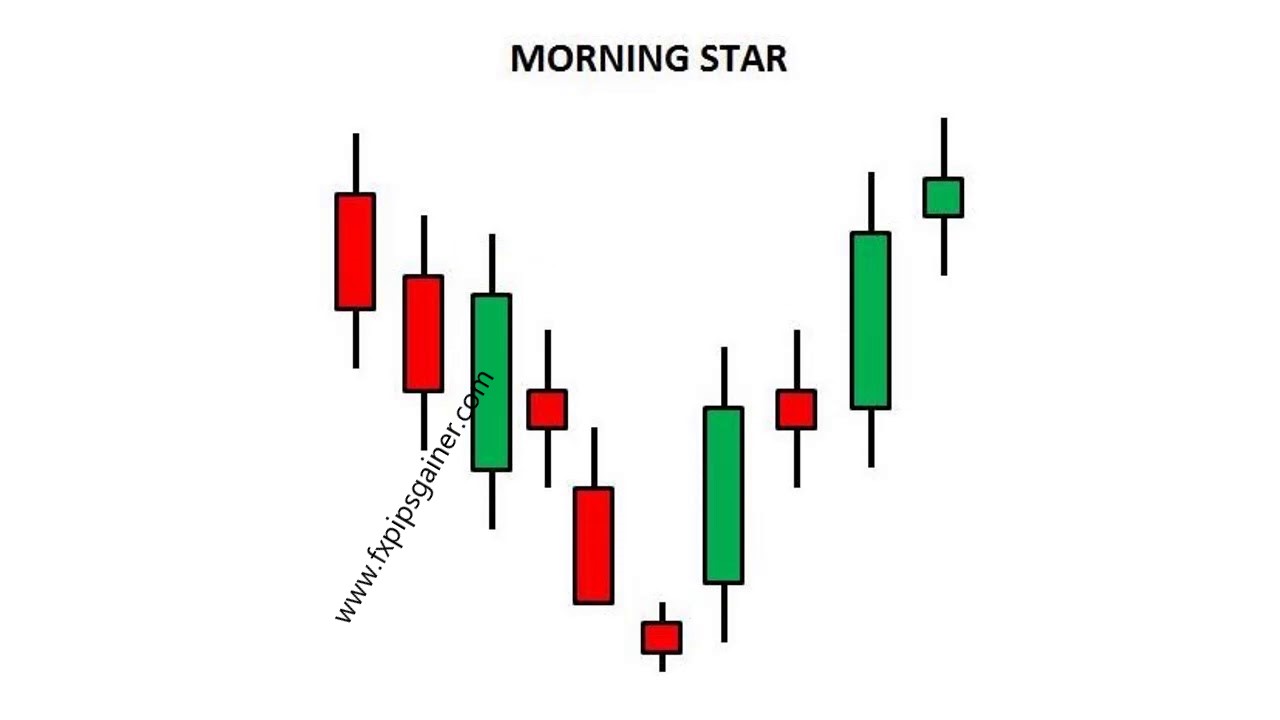

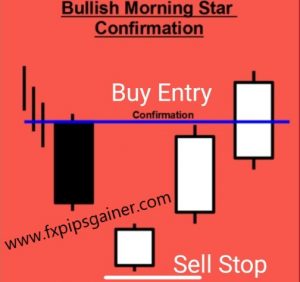

It is bullish reversal Pattern and formed by three candle after the end of downtrend market.

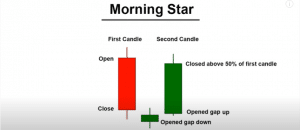

- A morning star is a visual pattern made up of a tall black candlestick, a smaller black or white candlestick with a short body and long wicks, and a third tall white candlestick.

- The middle candle of the morning star captures a moment of market indecision where the bears begin to give way to bulls. The third candle confirms the reversal and can mark a new uptrend.

- The opposite pattern to a morning star is the evening star, which signals a reversal of an uptrend into a downtrend.

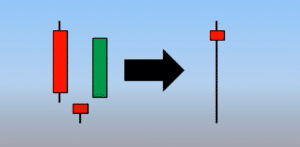

When three candle consist a morning star pattern that time this pattern we can compare with Hammer or bullish Pinbar.

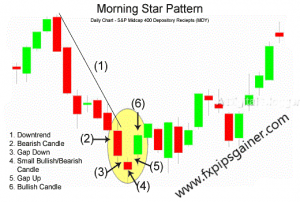

Characteristics of Morning start Pattern:

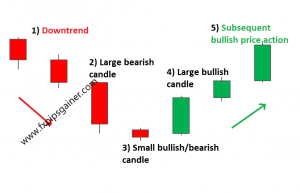

1.The first candle of the morning star pattern should be strong bearish red candle.

2.The 2nd candle is a short bullish or bearish doji, a small body candlestick that should open down with a gap.

3.The 3rd candle is the bullish open with gap up and it must close above the middle of the first candle.

4.This pattern must be formed at the support or over sold areas.

[…] Morning Star Candlestick Pattern […]