Maximize your profit by copy Our Trade

It is a type of financial chart that is more visually appealing than the common bar chart, thus making price action easier to interpret and analyze.

It can also help an investor make wiser buy and sell decisions because of its recognizable patterns.

Patterns play a very crucial role in trading, so here’s to a breakdown of the most helpful patterns for your daily trading needs.

Pin bars are one of the most powerful price action patterns in Forex trading as they are easy to recognize which means both professionals and retail traders use them.

The pin bar (also known as Pinocchio Bar) formation is a reversal setup. It is a one candle / bar formation that has an obvious large tail or shadow either up or down.

A pin bar is a single candlestick setup that clues price action into potential reversals in the market.It also has an elongated wick that sticks out.

There is also a Fake Pin Bar that is different than the normal pin bars.

Because of the price action, you can now determine the difference between the two. If a long wick sticks out from recent prices then it’s a pin bar, if the long wick does not stick out then

it’s not a genuine pin bar, but rather a ‘FAKE PIN BAR’.

Bearish pin bars form after several bullish candles and have a nose that is higher than the top of the previous candle.

The nose must be at least 75% of the candle size and the candle body must be less than 16%. (Vice Versa for a Bullish Pin Bar).

The best way to trade any market is to trade inline with the trend.

In a trending market, a pin bar entry signal can offer a better risk reward with lower risk.

If the pin bar shows a rejection to lower prices, it’s a bullish pin bar since the rejection shows the bulls or buyers are pushing price higher.

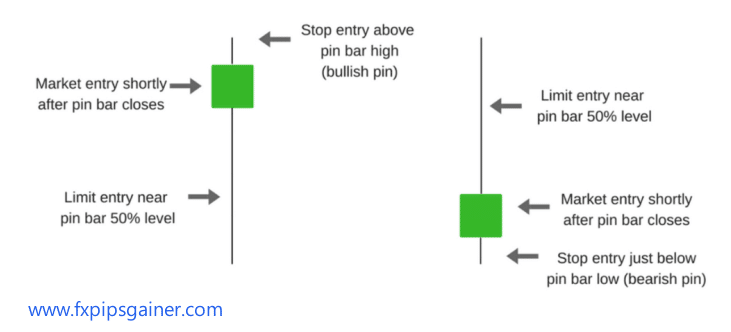

This entry involves taking a 50% retrace of the pin bar or other reversal candles wick.

For this entry you would be setting a trade entry and waiting for price to move higher or lower 50% in the opposite direction of where you actually want price to go for your trade.

You do this to get a much tighter stop loss and potentially higher reward pay off.

This entry on reversal trade signals involves entering as soon as price has closed. When the reversal candle such as the pin bar has closed and it meets your criteria, you simply enter the

trade.

With this entry type you are creating a trade entry and waiting for price to break higher or lower, above or below the pin bars high or low.

Price is then breaking in the direction that you are looking for price to move.

This is lower risk, but can create bigger stops that will give you lower reward.

Each entry has it payoffs for potential risk and reward.

Engulfing Bars = EB’s, also known as Outside Bars = OB’s are one of the most widely used strategies in Forex trading. EB’s can generate very accurate and reliable signals if identified and understood correctly.

There are two types of engulfing bars:

(1) Bullish Engulfing Bar.

(2) Bearish Engulfing Bar.

The bullish candle fully engulfs the previous candle. It can even engulf more than one candle, but to be a valid bullish engulfing bar, it must engulf at least one of the previous candles.

Maximize your profit by copy Our Trade

The bearish candle fully engulfs the previous candle.

Both Bullish and Bearish Engulfing Bars have a “lower low” and “higher high” like the preceding candle.

Looking for the engulfing bar is pretty simple. The candle should completely cover the previous candles range, taking out the previous high and low.

One of the most familiar candlestick patterns is the inside bar. It forms when price trades within the high and low ranges of a previous day.

You can call an inside bar a ‘breakout play’.

The best IB’s are made in trending markets with the direction of the trend.

The inside bar is formed when the second bar or candlestick is engulfed within the previous bar or candlestick high and low.

It is a two-bar price action trading strategy in which the inside bar is smaller and within high to low range of the prior bar. It can be at the top, middle or bottom of the bar.

You can see what it looks like in-line with a trending market below. As you can see below it is a down-trending market so the inside bar pattern would be called the inside bar sell signal.

Here’s another example; this time it’s an inside bar pattern with a trending market.

In this example, the market was trending higher so the inside bar would be referred to as the inside bar buy signal.

Maximize your profit by copy Our Trade

Inside bars can be traded both as reversals and market trend continuations.

The most commonly used entry with the inside bar is to place a buy stop or sell stop at the high or low of the mother bar. This way your entry order is filled when price breaks out above or

below the mother bar to confirm you move and to miss as many false inside bar moves as possible.

In technical analysis, support and resistance levels are the most important concepts to determine long and short trading opportunities.

Support is a price level where due to a concentration of demand, price will often turn around and be ‘supported’.

Resistance zones are the opposite to support zones and are levels in the market where price is finding more sellers and less demand; in other words, price is finding resistance.

Resistance zones can be great spots to target bearish reversal trades or to use with your exits.

If you can recognize the zones of support or resistance on your charts, it will provide both valuable entry and exit points.

Maximize your profit by copy Our Trade

There are 3 different types of markets. These are the uptrend (higher highs and lows), downtrend (lower highs and lows), and sideways trends (ranging).

Uptrend lines (valleys) are drawn along the bottom of identifiable support areas. And in a downtrend, lines (peaks) are drawn along the top of identifiable resistance areas.

So how can you draw them? It’s easy! Locate a minimum three major points that align higher or lower.

Market volatility is never-ending. As a trader, the hardest part is to mitigate against losses.

NOTE: Set your own stop losses depending on your individual preferences.

Below are some of the most popular and commonly used stop loss strategies.

You can place a stop loss behind the tail of the pin bar whether it’s bearish or bullish.

As a result, when price hits your stop loss, the pin bar setup will turn out to be invalid.

Remember that the market is just notifying you that your pin bar setup was not strong enough, don’t ever think that it’s a bad thing when price hits the stop loss.

Maximize your profit by copy Our Trade

The inside bar stop-loss strategy gives you two options on where you can place a stop-loss.

It can either be behind the inside bars high or low or even behind the mother bars high or low.

If you want a lower risk inside bar stop loss strategy, then it’s behind the mother bars high or low. Just like the pin bar stop loss strategy, the inside bar setup becomes invalid once hit.

Traders often use this kind of setup.

With this strategy you will use support and resistance levels,previous highs and lows, moving averages, trend lines, and channels to find an appropriate stop level.

The good thing about confluence stops is that they are often used at obvious price levels in the market.

Note: If price repeatedly takes out your stops by just a few points, add more confluence levels or add a little padding to place your stops outside the stop hunting zone.

Professional traders often use this strategy because it has the ability to adapt to changing market conditions.

If the volatility is high, you can use a larger stop loss for greater swings and you can shorten when the market calms down.

In times of high volatility, you should widen your targets to counter the reduced effect on reward: risk ratio.

If the volatility is low then you should set closer targets because price won’t travel as far.

Maximize your profit by copy Our Trade

Use entry price action patterns according to your own risk tolerance and how aggressive you are as a trader.

Always remember to use a stop loss and test the different stop loss strategies to see what suits you and your personality.