In terms of new data inputs, mainly US numbers and, more specifically, job data, it was a big week for investors. We hope to continue where we left off this week with important data that is once again expected from the states. In addition, since new developments in Israel and Palestine make headlines every day, geopolitical concerns will also have an impact on the market.

Maximize your profit by copy our trade

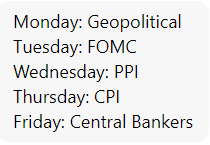

Here is our customary daily summary of the items traders should be watching the following week:

Monday :

Traders would often be seeking a little respite due to bank holidays in the US, Canada, and Japan, as well as a dearth of Tier 1 data releases. Even yet, the recent outbreak of hostilities in the Middle East will undoubtedly agitate markets, and significant swings are likely both during the day and on the open.

Tuesday:

Early in the session, the Asian market will be centred on Australia because of the release of the most recent NAB Business Confidence data, and new loan figures from China are also scheduled. The US markets will open this week, and the first of many FOMC members to speak is scheduled. That said, there isn’t much to worry about for the scorers in the London session.

Wednesday:

Kent, the deputy governor of the Reserve Bank of Australia, is scheduled to speak during the APAC session, and there aren’t many events scheduled for the European day. The PPI figures, the first of the week’s significant US data releases, are released at the New York Open. The final FOMC meeting minutes will be released later.

Thursday:

In terms of data releases, this is the biggest day of the week. There are no noteworthy releases scheduled for the Asian session, but at the London Open, investors will be focusing on the UK and the most recent GDP data, before attention returns to the US and the release of the crucial CPI inflation data along with the weekly jobless figures.

Friday:

The APAC session will feature the publication of the most recent Chinese CPI figures, making it a busy day to round off the week. The next two sessions will feature speeches by prominent central bankers, including FOMC member Harker, ECB President Lagarde, and Governor Bailey of the Bank of England. Additionally, the preliminary University of Michigan data is scheduled to be released later that day in New York.