Maximize your profit by copy our trade

EUR/USD: No Fed or ECB interest rate hikes in the near future?

– The U.S. Dollar Index (DXY) has been trading sideways since the last days of September.

– U.S. retail sales data for October showed a monthly increase of 0.7%, exceeding market forecasts.

– The ZEW Economic Sentiment Index for the Eurozone rebounded to 2.3, better than the forecast of -8.

– Eurozone consumer inflation in September was 4.3% YoY, matching expectations.

– U.S. initial jobless claims for October came in at 198K, below expectations.

– The U.S. economy shows strong employment and GDP growth, lower inflation, increased consumer activity, and a stable real estate market.

– Federal Reserve officials suggest that a rate hike is unlikely at the upcoming FOMC meeting.

– Economists have mixed opinions on the future of the EUR/USD exchange rate, with some expecting a stronger dollar and others predicting an upward trend.

– Technical analysis indicators for the EUR/USD pair are also mixed.

– Key upcoming events include PMI data releases, U.S. housing market data, remarks from Fed Chair Jerome Powell, the ECB interest rate decision, and U.S. GDP figures.

The direction of the future EUR/USD exchange rate is uncertain due to mixed opinions from experts, divergent macroeconomic data, and conflicting technical analysis indicators.

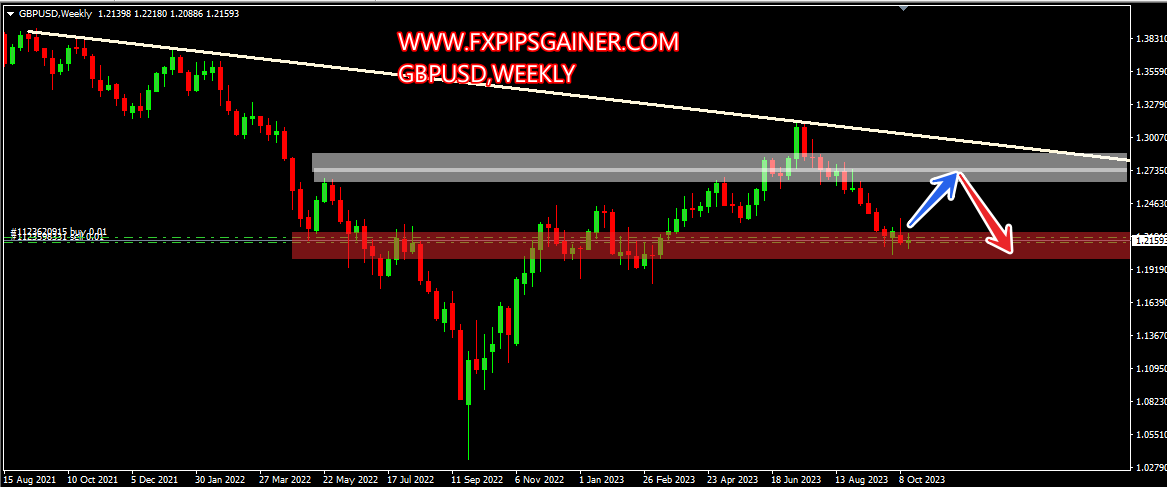

GBP/USD: Is the BoE Rate Going to Stay the Same?

– GBP/USD initially trended upwards from 1.2037 to 1.2337 but faced resistance and fell back.

– The British currency has lost approximately 7.5% against the dollar since mid-July.

– Geopolitical tensions and rising energy prices have led investors to view the dollar as a safe haven.

– UK’s economy is teetering on the edge, with GDP growth at 0.6% compared to 2.1% in the US, and inflation hovering around 6.7-6.8%.

– Bank of England (BoE) may focus on supporting the economy over combating inflation.

– Recent UK retail sales data showed a decline of -0.9%.

– Uncertainty remains for the pound, with analysts suggesting the rate hike cycle in the UK may have ended.

– Polls indicate a majority believe GBP/USD will continue moving towards the 1.2000 target.

– Technical indicators show a decline in the D1 timeframe, with mixed signals from oscillators.

– Support levels for GBP/USD include 1.2085-1.2130, 1.2040, 1.1960, and 1.1800, while resistance levels are at 1.2190-1.2215, 1.2270, 1.2330, 1.2450, 1.2510, 1.2550-1.2575, and 1.2690-1.2710.

– On October 24, data on the UK labor market and business activity will be released.

The future direction of the GBP/USD market in the near future appears uncertain due to complex factors such as geopolitical tensions, rising energy prices, and the UK’s economic situation.

USD/JPY: In the Face of Extended Uncertainty

1. Japanese officials, including the Bank of Japan Governor and Finance Minister, have made statements suggesting a mixed outlook for the Japanese economy, with moderate recovery but high uncertainty.

2. The Bank of Japan maintains an ultra-accommodative monetary policy and ignores rising inflationary pressures, which may lead to further decline in the yen against the dollar.

3. The possibility of the yen declining further against the dollar may be mitigated if U.S. interest rates decrease or if the Bank of Japan changes its Yield Curve Control (YCC) policy.

4. Strategists at Societe Generale believe that if U.S. yields continue to rise and the Bank of Japan only adjusts its inflation forecast, USD/JPY could surge above 150.00.

5. The short-term outlook for USD/JPY is uncertain, with 15% of experts expecting a push towards 150.00, 20% predicting a downward correction, and 65% remaining noncommittal.

6. On the technical side, trend indicators and oscillators on the D1 timeframe suggest a ‘buy’ signal, but some oscillators indicate potential overbought conditions.

7. Support levels for USD/JPY can be found at 149.60, 148.30-148.65, 146.85-147.25, and further down, while resistance levels are at 150.00-150.15, 150.40, 151.90, and 153.15.

8. No major economic data related to the Japanese economy is scheduled for release in the upcoming week, with the Tokyo Consumer Price Index being the only noteworthy item on October 27.

The future direction of the USD/JPY market appears uncertain due to mixed statements from Japanese officials, potential factors influencing the yen’s decline, and a lack of consensus among experts regarding short-term movements.

Cryptocurrencies: The Actual Market Upswing Caused by False Information Regarding BTC-ETF

– On October 16, the price of Bitcoin surged to $30,102 before dropping to $27,728, leading to the liquidation of over 33,000 trading positions and losses totaling $154 million.

– The surge was triggered by the publication of fake news by Cointelegraph, claiming that the U.S. Securities and Exchange Commission (SEC) had approved BlackRock’s application for a spot Bitcoin exchange-traded fund (ETF).

– The SEC clarified that the news was false and advised caution in online information.

– Applications for spot Bitcoin ETFs were previously rejected by the SEC in 2021, but a new wave of applications, including from BlackRock and other financial institutions, has been submitted.

– The approval of spot Bitcoin ETFs is expected to drive institutional investor adoption and potentially increase the market capitalization of the crypto space by $1 trillion.

– Opinions on the future of Bitcoin vary, with some experts predicting prices of $100,000 or even $200,000, while others suggest a bearish outlook with a potential drop to $19,000-$23,000.

– Bitcoin made another attempt to breach the $30,000 mark on October 20, reaching $30,207 before retracing.

– The overall market capitalization of the crypto market stands at $1.120 trillion, and the Crypto Fear & Greed Index has moved from the ‘Fear’ zone to the ‘Neutral’ zone.

The future direction of BTC/USD remains uncertain due to mixed opinions and factors such as regulatory actions, institutional adoption, and overall market conditions.