Maximize your profit by copy Our Trade

Why EUR/JPY Trading is Profitable

Many traders overlook the advantages of trading cross-currency pairs. EUR/JPY stands out, not just as another pair, but for its unique characteristics that can enhance trading strategies. Here’s a comprehensive guide to understanding why trading EUR/JPY can be particularly profitable.

Understanding Currency Pairs

Major vs. Cross-Currency Pairs

- Major Currency Pairs: These pairs include the USD and are among the most traded currencies. Examples include EUR/USD and GBP/USD.

- Cross-Currency Pairs: Pairs that do not include the USD. EUR/JPY is a prominent example, known for smoother price action and stronger trends.

Advantages of Trading EUR/JPY

1. Smoother Price Action

- Trend Development: EUR/JPY often experiences smoother price movements compared to major pairs. This is because it’s less influenced by the volatility of the USD.

- Stronger Trends: Cross pairs like EUR/JPY can develop stronger trends, making them appealing for trend-following strategies.

2. Isolation from USD News Effects

- Reduced Volatility from US Events: US dollar-based currencies are susceptible to sudden price changes influenced by US economic news. Trading EUR/JPY allows you to potentially avoid these spikes, leading to more stable trading environments.

The Nature of Trends in Forex

Importance for Trend-Following Traders

- Trend Persistence: Strong trends in the forex market occur only about 30% of the time. Thus, selecting the right currency pair can significantly improve trading success.

Most Trending Currency Pairs

- Top Pairs: Pairs like GBP/JPY and EUR/JPY exhibit stronger trends compared to others, making them ideal for traders focused on trend-following.

- Performance Metrics: Over the past five years, EUR/JPY has shown an average weekly rate of change of 1.24%, placing it among the most trending pairs.

Measuring Trends Effectively

Statistical Analysis

- Trend Characteristics: An uptrend features higher highs (HH) and higher lows (HL), while a downtrend is characterized by lower lows (LL) and lower highs (LH).

- Recent Analysis: Weekly statistics indicate EUR/JPY ranks as one of the best trends alongside GBP/JPY.

Developing a Trading Strategy for EUR/JPY

Step-by-Step Guide

Step 1: Market Research

Trade Now

- Understand Market Conditions: Research economic indicators that impact the Eurozone and Japan, including GDP reports, interest rates, and geopolitical events.

Step 2: Technical Analysis

- Identify Key Levels: Use support and resistance levels to gauge potential entry and exit points.

- Utilize Technical Indicators: Employ moving averages and momentum indicators to identify trends and confirm trade signals.

Step 3: Develop a Trading Plan

- Define Risk Management: Establish stop-loss and take-profit levels to manage risk effectively.

- Position Sizing: Determine the size of each trade based on your risk tolerance and capital.

Step 4: Execute Trades

- Entry and Exit Points: Execute trades at identified key levels, ensuring adherence to your trading plan.

- Monitor Trades: Keep an eye on market movements and adjust positions as needed based on real-time analysis.

Step 5: Review and Adjust

- Post-Trade Analysis: Regularly review your trades to identify what worked and what didn’t.

- Adapt Strategies: Make necessary adjustments to your trading strategy based on your analysis and changing market conditions.

How to Trade EUR/JPY

Trading the EUR/JPY currency pair involves a unique structure in the forex market, known as “legging.” This guide will break down how to effectively trade EUR/JPY and how to analyze related major pairs to make informed decisions.

Understanding Legs in Forex Trading

What is a “Leg”?

In the context of forex trading, a “leg” refers to a segment of a transaction involving currency pairs. When trading cross pairs like EUR/JPY, multiple transactions are involved, resulting in a more complex structure.

Constructing the EUR/JPY Trade

- Buying EUR/USD: The first leg involves buying Euros while selling US Dollars.

- Buying USD/JPY: The second leg involves buying US Dollars while selling Japanese Yen.

In this process:

- The purchase and sale of USD in both legs cancel each other out.

- The outcome leaves you with a long position in EUR and a short position in JPY, effectively making you long EUR/JPY.

How to Analyze EUR/JPY

Importance of Analyzing Related Pairs

To successfully forecast the EUR/JPY movement:

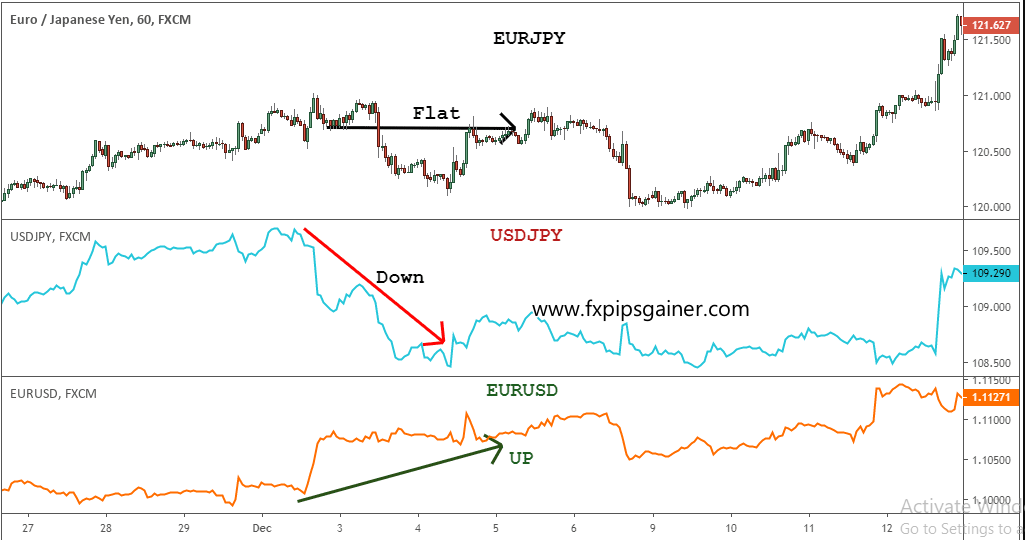

- You must analyze both EUR/USD and USD/JPY charts.

- Understanding how these major pairs interact will give you insight into potential movements in EUR/JPY.

Step-by-Step Trading Strategy for EUR/JPY

Step 1: Conduct Market Research

- Economic Indicators: Monitor economic indicators from the Eurozone and Japan, such as GDP growth, inflation rates, and interest rate announcements.

- News Events: Stay updated on geopolitical events and central bank policies that may impact currency valuations.

Step 2: Technical Analysis

- Chart Patterns: Use chart patterns in both EUR/USD and USD/JPY to identify potential trends.

- Indicators: Employ technical indicators like Moving Averages, RSI, and MACD to establish entry and exit points.

Step 3: Monitor Correlations

- Correlation Analysis: Understand the correlation between EUR/USD and USD/JPY. This helps you gauge how movements in one pair may influence the EUR/JPY.

- Diversification: By analyzing correlations, you can avoid having too much exposure to similar price movements across different pairs.

Step 4: Define Entry and Exit Points

- Entry Signals:

- Look for bullish signals in EUR/USD combined with bearish signals in USD/JPY to confirm a long position in EUR/JPY.

- Exit Strategy:

- Set target levels based on previous resistance/support levels from both EUR/USD and USD/JPY.

Step 5: Implement Risk Management Strategies

- Stop-Loss Orders: Always place stop-loss orders to manage potential losses.

- Position Sizing: Calculate the appropriate size of each trade based on your overall risk tolerance and account size.

Step 6: Execute the Trade

- Placing Orders: Execute trades simultaneously for EUR/USD and USD/JPY to lock in your desired position in EUR/JPY.

- Monitor Trades: Keep an eye on your trades and adjust triggers as necessary based on market conditions.

Step 7: Review and Learn

- Post-Trade Analysis: After closing trades, analyze outcomes to identify successful strategies and areas for improvement.

- Adjust Strategies: Modify your approach based on market trends and your analytical insights.

Best Times to Trade EUR/JPY

Timing Considerations

- Market Hours: The best times to trade EUR/JPY are during the overlap of the European and Asian trading sessions, as this period usually sees increased volatility and liquidity.

- Economic Releases: Pay attention to economic release schedules for the Eurozone and Japan, as these can significantly influence the market.

Trade Now

Simple EUR/JPY Trading Strategy

This section outlines a straightforward EUR/JPY trading strategy utilizing currency correlation for effective forecasting. Follow the steps below to implement this strategy successfully.

Step 1: Understand Currency Correlation

Cross-Pair Trading

- Recognize that trading EUR/JPY involves both EUR/USD and USD/JPY simultaneously.

- The movement of these pairs impacts the EUR/JPY cross.

Avoiding Bad Trades

- Stay out of EUR/JPY trades under certain conditions:

- Condition 1: If EUR/USD is rising and USD/JPY is falling, avoid trading EUR/JPY.

- Condition 2: If EUR/USD is falling and USD/JPY is rising, avoid trading EUR/JPY.

- In these scenarios, EUR/JPY typically remains flat.

Step 2: Identify the “Perfect Storm Setup”

Long Trade Setup

- For a viable EUR/JPY long position, ensure that:

- EUR/USD is hitting support levels and rallying.

- USD/JPY is also hitting support levels and rallying.

Short Trade Setup

- For a viable EUR/JPY short position, ensure that:

Step 3: Execute the Trade

- Confirm Conditions: Before entering a trade, wait for the “perfect storm” setup to manifest across all three currency pairs (EUR/JPY, EUR/USD, USD/JPY).

- Entry Point: Implement the trade based on your setup (buy for long, sell for short).

Step 4: Implement Risk Management

Set Stop-Loss Orders

- Always use a protective stop-loss to minimize potential losses.

- Refer to guides like “Stop-Loss Trading Strategy – 2 Tips To Safe Your SL” for more information on stop-loss strategies.

Define Take-Profit Targets

- Set clear take-profit levels based on your analysis.

- Consider resources like “The Secret of Taking Profit and Why it is Important” to develop effective take-profit strategies.