Diagonal Triangle Pattern

Diagonal Triangle Pattern Maximize your profit by copy Our Trade

Maximize your profit by copy Our Trade

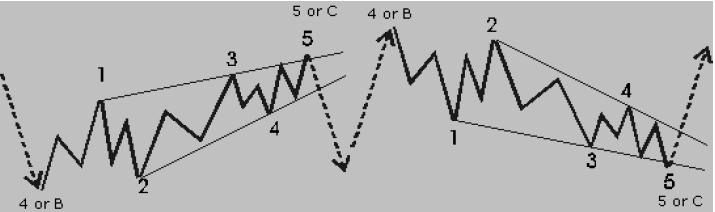

Diagonals are sort of impulsive patterns, which normally occur in terminal waves like a fifth or a C wave. Don’t confuse them with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees on intra-day charts. Usually Diagonal triangles are followed by a violent change in market direction.

The most important rules and guidelines are:

• It is composed of 5 waves.

• Waves 4 and 1 do overlap.

• Wave 4 can’t go beyond the origin of wave 3.

• Wave 3) cannot be the shortest wave.

• Internally all waves of the diagonal have a corrective wave structure.

• Wave 1 is the longest wave and wave 5 the shortest.

• The channel lines of Diagonals must converge.

• As a guideline the internal wave structure should show alternation, which means different

kind of corrective structures.

Diagonal triangles type 1 occur in waves 5, C, and sometimes in wave 1.

Internal structure.

The internal structure of the five waves is 3-3-3-3-3.

It’s arduous to search out knowledgeable individuals on this matter, however you sound like you recognize what you’re speaking about! Thanks