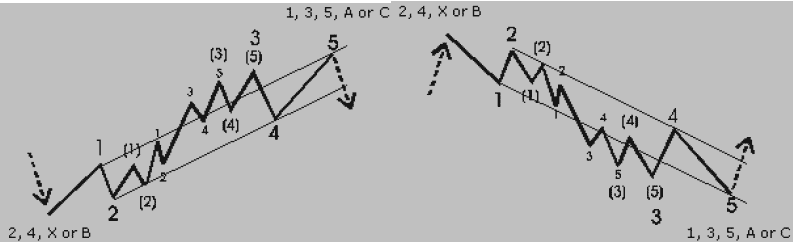

Diagonal type 2 is a sort of impulsive pattern, which normally occurs in the first or A wave. The main difference with the Diagonal Triangle type 1 is the fact that waves 1, 3 and 5 have an internal structure of five waves instead of three. Experience shows it can also occur in a wave 5 or C, though the Elliott Wave Principle does not allow this. Don’t confuse this with corrective triangles.

Diagonals are relatively rare phenomena for large wave degrees, but they do occur often in lower wave degrees in intra day charts. These Diagonal triangles are not followed by a violent change in market direction, because it is not the end of a trend, except when it occurs in a fifth or a C wave.

• It is composed of 5 waves.

• Wave 4 and 1 do overlap.

• Wave 4 can’t go beyond the origin of wave 3.

• Wave 3) cannot be the shortest wave.

• Internally waves 1, 3 and 5 have an impulsive wave structure.

• Wave 1 is the longest wave and wave 5 the shortest.

• As a guideline the internal wave structure should show alternation, which means that

wave 2 and 4 show a different kind of corrective structure.

Diagonal triangles type 2 occur in waves 1 and A.

The five waves of the diagonal type 2 show an internal structure of 5-3-5-3-5.