Maximize your profit by copy our trade

1. On the weekly chart, a reversal occurred after 11 consecutive black candles, with the reversal happening on the 9th reversal candle according to the Sequential indicator.

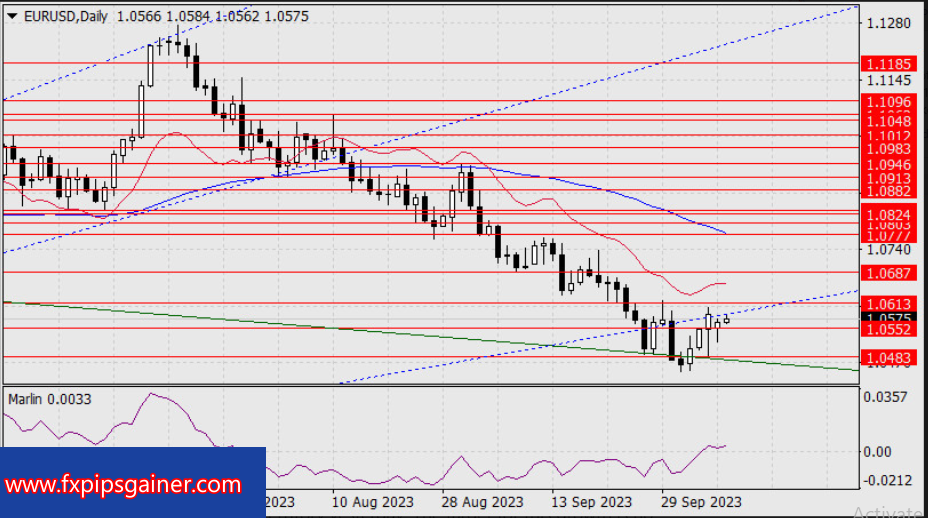

2. On the daily chart, a reversal was witnessed from the 9th candle, followed by an intermediate 10th candle, indicating the start of a new upward wave.

3. The expectation is for the pair to rise in the medium-term, potentially surpassing the previous peak in July.

4. The complex situation regarding the U.S. budget compared to a week ago is the basis for this growth.

5. On the daily chart, the euro remained above the level of 1.0552, with the price needing to overcome Fibonacci retracement resistance and the level at 1.0613.

6. The Marlin oscillator remained in the bullish territory, with the target for this growth set at the MACD line around 1.0777.

7. On the 4-hour chart, the price has turned upwards from the MACD line and consolidated above 1.0552. The Marlin oscillator is still in the uptrend territory, suggesting further upward movement for the euro.

The future direction for the euro appears to be upward, with expectations of continued rise in the medium-term, potentially surpassing previous highs, supported by the complex situation regarding the U.S. budget and positive indicators on the daily and 4-hour charts.