Maximize your profit by copy our trade

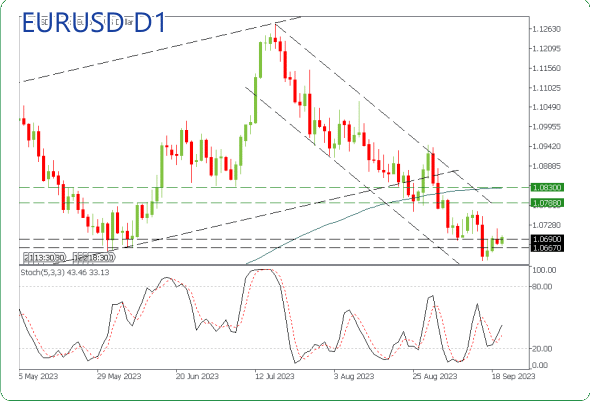

The given statement suggests that the EURUSD currency pair has reached a support cluster between the price levels of 1.06670 and 1.06900. A support cluster refers to a zone where multiple support levels coincide, which can potentially act as a barrier to further downward price movement.

The statement also mentions that the stochastic lines have intersected, indicating a potential attempt by bullish traders to counterattack and drive the price higher. However, despite this counterattack, the local trend is still bearish, implying that the overall market sentiment and price direction are downward.

Considering these factors, the statement suggests that taking long positions (buying) in the EURUSD pair is risky. This caution is likely due to the conflicting signals in the market, with bullish pressure at the support cluster but a prevailing bearish trend.

Furthermore, the statement mentions the upcoming Federal Reserve (Fed) meeting, which is expected to introduce significant volatility into the market. Central bank meetings, such as the Fed meeting, often involve important policy decisions that can impact currency markets. Traders are advised to trade carefully during such events because the market can experience sharp and unpredictable price movements.

In summary, the statement advises caution when trading the main Forex currency pair, EURUSD. Despite the support cluster and the presence of bullish pressure, the overall trend is bearish, and long positions are considered risky. Additionally, the anticipation of increased volatility during the upcoming Fed meeting further emphasizes the need for careful trading.

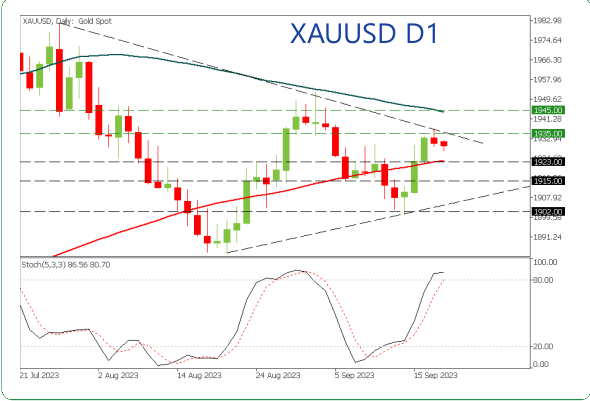

The statement suggests that the XAUUSD (Gold) price has rebounded from a trendline and the resistance level of $1935. In the daily timeframe, the 100-day moving average (100MA) is still declining. It is anticipated that Gold might attempt to test the 200-day moving average (200MA) around $1923. Additionally, the fast stochastic line is poised to reverse and cross its slow line in the overbought zone, which is considered a bearish signal. Overall, these factors indicate a potential bearish outlook for the future market movement of Gold.