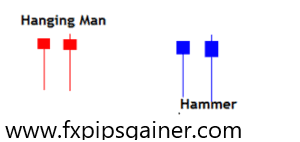

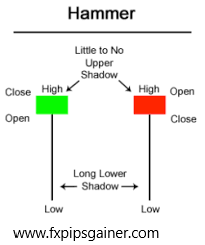

Hammer

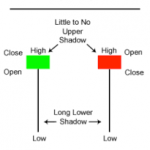

- Hammers have a small real body and a long lower shadow.(Body is 1/3 of tail)

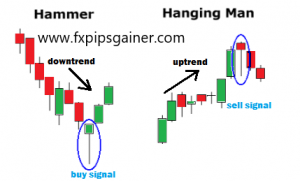

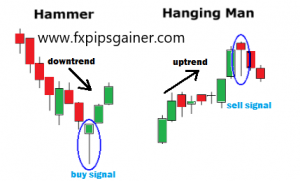

- Hammers occur after a downtrend or a price decline.

- The hammer candlestick shows sellers came into the market during the period but by the close, the selling had been absorbed and buyers had pushed the price back to near the open.

- The close can be above or below the open, although the close should be near the open in order for the real body to remain small.

- It is a bullish reversal pattern.

- The lower shadow should be at least two times the height of the real body.

- Hammer candlesticks indicate a potential price reversal to the upside. The price must start moving up following the hammer; this is called confirmation.

Hanging Man

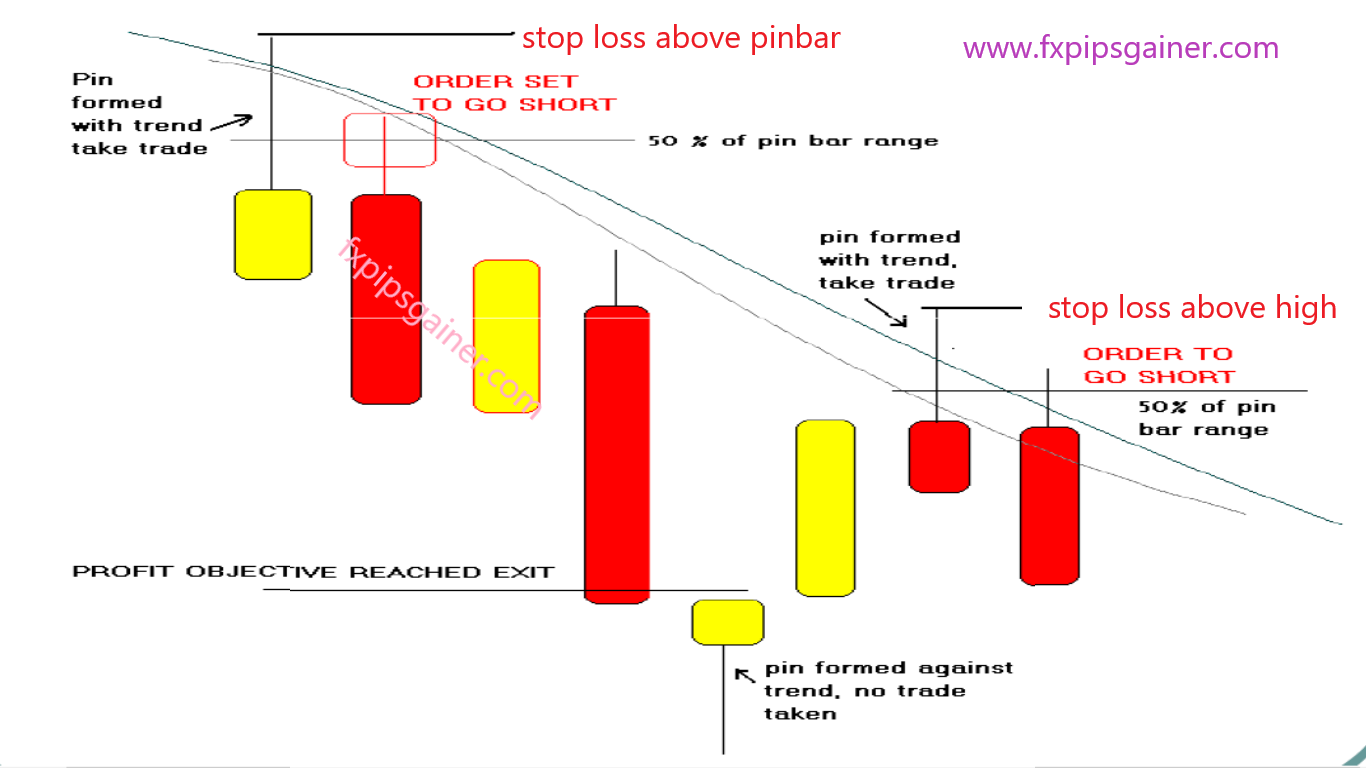

- A hanging man is a bearish reversal candlestick pattern that occurs after a price advance. The advance can be small or large but should be composed of at least a few price bars moving higher overall.

- The candle must have a small real body and a long lower shadow that is at least twice the size as the real body. There is little or no upper shadow.

- The close of the hanging man can be above or below open, it just needs to be near the open so the real body is small.

- The long lower shadow of the hanging man shows that sellers were able to take control for part of the trading period.

- The hanging man pattern is just a warning. The price must move lower on the next candle in order for the hanging man to be a valid reversal pattern. This is called confirmation.

- Traders typically exit long trades or enter short trades during or after the confirmation candle, not before.