Maximize your profit by copy our Trade

The Hanging Man Candlestick Pattern

The Hanging Man is a significant Japanese candlestick pattern that traders often use to identify potential bearish reversals in the market.

What Is the Hanging Man Candlestick Pattern?

- Type: Bearish reversal pattern

- Context: Usually appears after a price move to the upside

- Indication: Shows rejection from higher prices

- Significance: It suggests that a downward price movement may follow after the pattern forms.

Characteristics of the Hanging Man Pattern

1. Appearance

- Small Body: The body of the candle is relatively small compared to the overall candle’s range.

- Long Lower Wick: The wick at the bottom must be significantly larger than the body.

- Minimal or No Upper Wick: At the top, there should be little to no wick, indicating that buyers failed to maintain higher prices.

2. Color of the Body

The color of the body does not matter; it can be either red (bearish) or green (bullish).

3. Context of Formation

The Hanging Man typically forms after a bullish trend, signaling that the upward momentum may be weakening.

How to Identify the Hanging Man Candlestick Pattern

Step-by-Step Identification

- Look for an Uptrend: Ensure that the price has been moving upwards before the formation of the Hanging Man.

- Identify the Candle:

- The candle should have a small body.

- There must be a long lower wick.

- The upper part of the candle should have little to no wick.

- Confirm the Pattern: Watch for subsequent bearish candles to confirm the reversal.

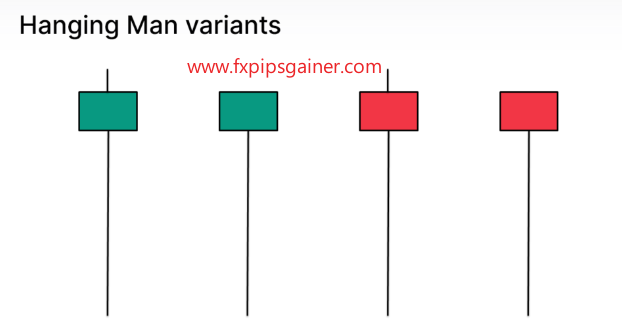

Variants of the Hanging Man Candlestick Pattern

The Hanging Man can vary slightly in appearance on different charts:

- Body Color: The body can be red or green.

- Bottom Wick: The bottom wick can vary in size, but it must remain long enough to signify rejection.

The Hanging Man candlestick pattern is a powerful signal in technical analysis for traders looking to identify potential reversals. Recognizing this pattern can help you anticipate bearish movements, especially when it follows a bullish trend.

How to Trade the Hanging Man Candlestick Pattern

Trading the Hanging Man candlestick pattern involves more than just identifying the shape on your charts. Understanding the context and implementing effective trading strategies is crucial for success.

1. Understanding the Context

Before trading the Hanging Man pattern, it’s essential to recognize that not all similar-looking candlestick shapes signify the same thing. For instance, the Hammer candlestick pattern has a similar appearance but conveys a different meaning.

- Location Matters: The validity of the Hanging Man pattern depends on where it appears. It should follow a bullish trend and indicate a potential reversal.

2. Identifying the Bullish Move

To successfully trade the Hanging Man pattern, first ensure that the price has moved upwards:

- Price Action: Look for a clear bullish trend before the appearance of the Hanging Man. This establishes a context for potential reversal.

3. Confirming the Hanging Man

Once you’ve identified the bullish move, look for the Hanging Man pattern:

- Candle Characteristics: The candle should have a small body, a long lower wick, and little to no upper wick.

- Appearance: This pattern should appear at the top of the bullish trend.

4. Triggering the Trade

When it comes to executing the trade, follow these steps:

- Entry Point: Open your short position when the low of the Hanging Man candle is broken. This serves as a conservative entry point, confirming the reversal signal.

5. Setting a Stop Loss

Protecting your capital is essential in trading. Here’s how to set an effective stop loss:

- Stop Loss Placement: A common method is to place your stop loss just above the high of the Hanging Man candle. This allows for some price fluctuation while protecting you from larger losses in case the market moves against you.

6. Monitoring the Trade

After entering the trade, keep an eye on the price action:

- Price Movement: Watch for subsequent bearish candles confirming the downward trend.

- Adjusting Stop Loss: As the trade moves in your favor, consider moving your stop loss to lock in profits.

7. Exiting the Trade

Finally, determine your exit strategy:

- Profit Target: Set a profit target based on support levels or previous price action. Decide in advance how much profit you aim to secure.

Strategies to Trade the Hanging Man Candlestick Pattern

Strategy 1: Pullbacks on Naked Charts

The Hanging Man candlestick pattern is an effective signal for traders looking to capitalize on bearish reversals. This strategy focuses on identifying pullbacks during a downtrend, allowing traders to enter positions with a high probability of success.

1. Understanding the Downtrend

Before you can effectively trade the Hanging Man pattern, it’s crucial to confirm that the market is in a downtrend:

- Identify the Trend: Use moving averages, trend lines, or simply observe the price action to ensure that the market is consistently making lower highs and lower lows.

2. Waiting for a Pullback

During a downtrend, the price may temporarily reverse direction, creating a pullback. Your goal is to recognize when this pullback is happening:

- Look for Retracements: Watch for price movements that move against the downtrend. This could be a minor upward movement that creates opportunities for short positions.

3. Spotting the Hanging Man Pattern

As the pullback progresses, keep an eye out for the Hanging Man candlestick pattern:

- Identify the Candle: Ensure that the candle has a small body, a long lower wick, and little to no upper wick. This indicates rejection of higher prices and potential reversal.

4. Confirming the Reversal

Once you spot the Hanging Man pattern, confirm that it marks the end of the pullback:

- Volume Confirmation: Look for increased trading volume accompanying the Hanging Man. Higher volume can validate the strength of the reversal signal.

5. Entering the Trade

When you are confident in the reversal signal provided by the Hanging Man, it’s time to enter your trade:

- Entry Point: Place a sell order when the low of the Hanging Man candle is broken. This confirms that the market is moving downward.

6. Setting Your Stop Loss

To protect your trading capital, setting an appropriate stop loss is vital:

- Stop Loss Placement: Position your stop loss just above the high of the Hanging Man candle. This allows for minor price fluctuations while safeguarding against significant losses.

7. Monitoring the Trade

After entering the trade, actively monitor the price action:

- Watch for Confirmation: Look for subsequent bearish candles to confirm the downtrend. Adjust your stop loss if the market moves in your favor.

8. Exiting the Trade

Determine your exit strategy based on your trading goals:

- Profit Target: Set a profit target based on previous support levels or a risk-reward ratio that aligns with your trading plan.

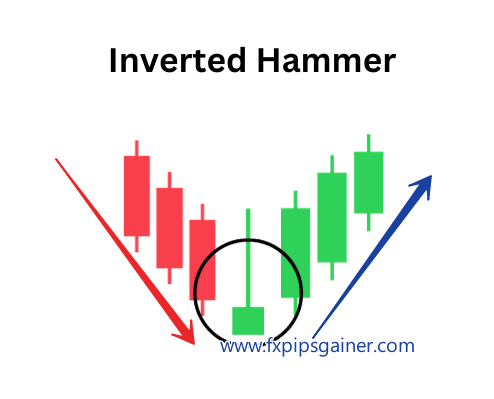

Comparative study among Hammer,Hanging man, Inverted Hammer and Shooting Star

Candlestick Patterns Comparison

| Criteria | Hammer | Hanging Man | Inverted Hammer | Shooting Star |

|---|---|---|---|---|

| 1. Market Trend | Occurs in a downtrend | Occurs in an uptrend | Occurs in a downtrend | Occurs in an uptrend |

| 2. Body Size | Small body | Small body | Small body | Small body |

| 3. Shadow Length | Long lower shadow | Long lower shadow | Long upper shadow | Long upper shadow |

| 4. Market Sentiment | Bullish reversal signal | Bearish reversal signal | Bullish reversal signal | Bearish reversal signal |

| 5. Confirmation Needed | Next candle should close higher | Next candle should close lower | Next candle should close higher | Next candle should close lower |

Recent Posts

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

- Fundamental Strategy Overview: XAUUSD (Gold)

Riley here — I’ve tried exploring governance and the low fees impressed me.

I personally find that the staking process is simple and the accurate charts makes it even better.