Maximize your profit by copy our trade

Thursday is expected to be an eventful day in the financial markets, with several important reports and the European Central Bank (ECB) meeting taking place. Here is a summary of the key points:

1. Reports in the US: The US will release important reports on GDP and orders for durable goods. With a forecast of 4.3% for GDP and 1.7% for orders, there is an expectation that these positive figures could lead to a rise in the value of the US dollar.

2. European Central Bank Meeting: The ECB meeting will be held on Thursday, and while the interest rate is expected to remain unchanged at 4.5%, ECB President Christine Lagarde’s speech may have an impact on the market. However, recent speeches by Lagarde have not had a significant effect on the market, so it is uncertain how the market will react to her remarks. It is noted that the market reaction to the ECB meeting itself may be weak, as seen in the past.

3. Euro and Pound: The outcome of the ECB meeting can influence not only the euro but also the pound. If the euro moves higher, it may pull the pound up with it. Therefore, traders should consider the potential impact on both currencies.

4. Volatility and Reversals: The combination of important reports and the ECB meeting may lead to increased volatility in the market. Traders should be prepared for frequent reversals as events and reports can vary in nature.

5. Trading System and Rules: The provided trading system outlines several rules to consider, such as signal strength, disregarding false signals, trading during specific sessions, using MACD signals, and identifying support and resistance zones. These rules can be helpful in guiding trading decisions.

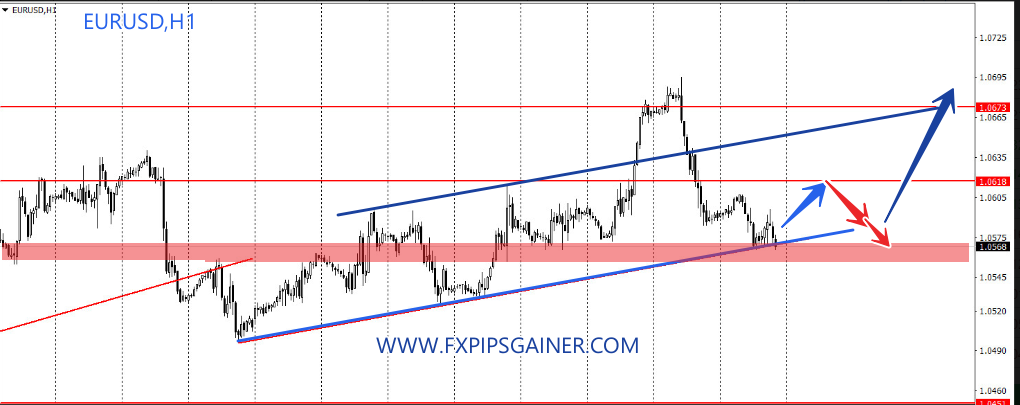

6. Chart Analysis: The chart analysis emphasizes the importance of support and resistance levels as targets for buying or selling. Red lines represent channels or trend lines indicating the current market trend. The MACD(14,22,3) indicator is mentioned as an auxiliary tool for signal confirmation.

7. Caution During Significant Speeches and Reports: It is advised to exercise caution and potentially exit the market during the release of significant speeches and reports to avoid sudden price reversals against the prevailing trend.

8. Importance of Strategy and Money Management: Traders, especially beginners, are reminded of the importance of establishing a clear strategy and implementing sound money management practices for long-term trading success.

It’s important to note that the information provided is based on the given context, and actual market outcomes may differ. Traders should conduct their own research and analysis to make informed trading decisions.

Today,is expected to be a volatile day in the financial markets, with important reports and the ECB meeting influencing market direction, potentially leading to a rise in the US dollar.