Maximize your profit by copy our Trade

What Is a Mitigation Block (MB)?

A Mitigation Block (MB) is a special type of Order Block within ICT’s Smart Money Concepts. It forms when the market makers or large institutions need to mitigate (offset) previously placed orders before continuing the trend in a new direction.

In simple terms, a Mitigation Block is a zone created after the market structure shifts, and it often becomes a support or resistance level for future price movement.

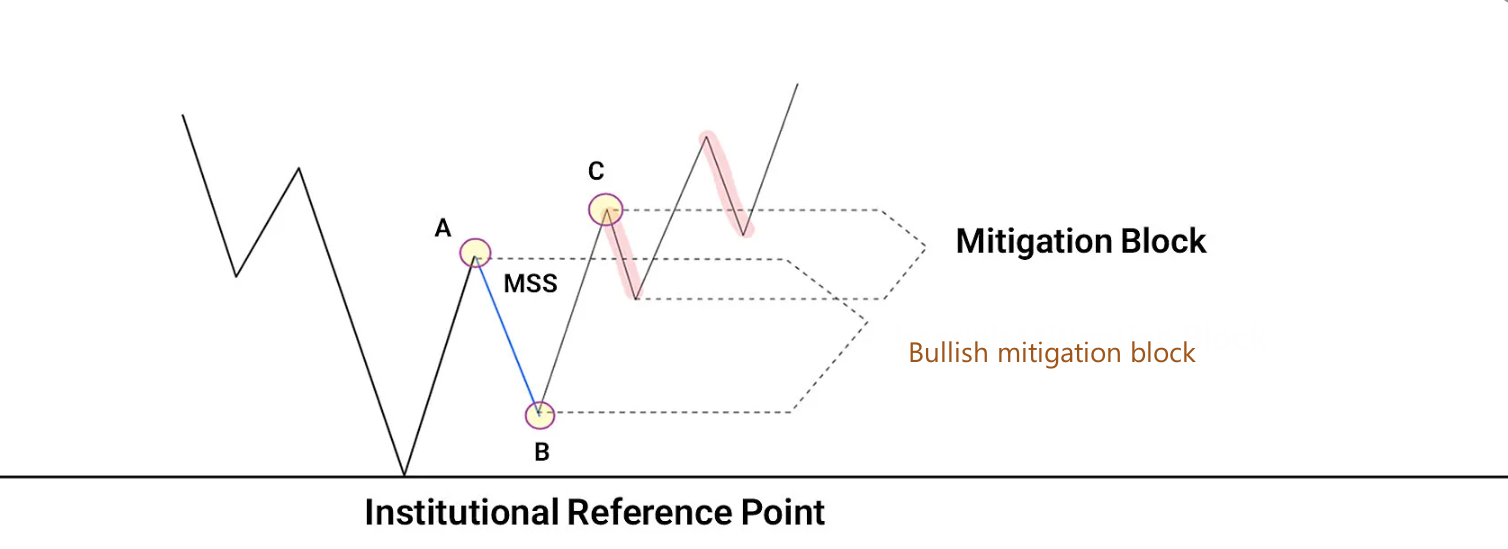

How a Mitigation Block Forms

A Mitigation Block appears when the following happens:

The market attempts to continue its existing trend

(e.g., moving upward by forming Higher Highs and Higher Lows).Price reaches an opposing reference level

(such as a strong supply zone during an uptrend).Price fails to make a new high or low, showing the trend is weakening.

A market structure break (MSB) occurs

—for example, the price breaks the previous Higher Low (HL) in an uptrend.The candle or zone responsible for that failed continuation becomes the Mitigation Block.

After the structure break, price often retraces into this block, allowing smart money to:

Fill unfilled orders

Mitigate earlier buy/sell positions

Continue pushing price in the new direction

This retracement into the Mitigation Block frequently creates a high-probability entry point.

Mitigation Block Example (XAG/USD – 15-Min Chart)

Let’s break down your example in a clean, reader-friendly way:

1. Trend Continuation Phase

The market was in an uptrend, producing:

Higher Highs (HH)

Higher Lows (HL)

This confirms bullish momentum.

2. Price Meets a Bearish Reference Area

Once the price reached a significant bearish supply zone, it:

Failed to create a new Higher High

Showed signs of bullish exhaustion

This signals that institutional selling pressure may be entering the market.

3. Market Structure Shifts Bearish

Price then broke the previous Higher Low, switching the structure from bullish to bearish.

This break is crucial—it confirms that buyers have lost control.

4. The Mitigation Block Forms

The last bullish candle (or small zone) before the structure break becomes the Mitigation Block.

This is the area where:

Smart Money had previous buy orders

Institutions mitigate (cover) those earlier positions

New sell orders are placed to push price lower

5. Price Retraces Into the MB

After the market structure turns bearish, price typically retraces back into the Mitigation Block, creating a high-probability sell opportunity.

This is where traders look for:

A clean retest

Confirmations like rejections, imbalance fills, or SMC entry triggers

Why Mitigation Blocks Matter

Mitigation Blocks help traders understand:

Where institutional orders are located

Where price is likely to react

High-probability entry zones after a structure shift

Points where the market corrects inefficiencies

They are powerful tools for structure-based trading, especially within ICT’s SMC framework.

Maximize your profit by copy our Trade

How to Identify a Mitigation Block

Mitigation Blocks can be spotted by understanding how the trend weakens and how Smart Money mitigates (offsets) previous orders before pushing the price in a new direction.

There are two types of Mitigation Blocks:

1. Bearish Mitigation Block

A Bearish Mitigation Block (MB) forms when an uptrend is coming to an end and the price is preparing to reverse downward.

How It Forms

The price is moving upward, creating:

Higher Highs (HH)

Higher Lows (HL)

Price reaches a strong bearish level (supply zone or institutional reference level).

Price fails to create a new Higher High, showing the buying strength is weakening.

Price then breaks below the previous Higher Low (HL) → this confirms a Bearish Break of Structure (BOS).

The last bullish candle or small zone that caused the structure break becomes the Bearish Mitigation Block.

How to Identify a Bearish Mitigation Block (Step-by-Step)

Higher Timeframe (HTF):

Price reaches a major resistance or supply zone.

Lower Timeframe (LTF):

Price forms HH → HL (showing bullish structure)

HL fails to create a new HH

Price breaks the HL → BOS occurs

The price pulls back into the zone between:

The broken HL, and

The Lower High (LH) that failed to push upward

This area = Bearish Mitigation Block

What This Zone Means

Traders who bought late are trapped and reduce losses.

Smart Money uses this zone to mitigate earlier buy positions and open new sell positions.

2. Bullish Mitigation Block

A Bullish Mitigation Block (MB) forms when a downtrend is losing strength and the price is preparing to reverse upward.

How It Forms

Price is moving downward, creating:

Lower Lows (LL)

Lower Highs (LH)

Price reaches a strong support level or demand zone.

Price fails to create a new Lower Low (LL), signaling seller exhaustion.

Price then breaks above the previous Lower High (LH) → confirming a Bullish Break of Structure (BOS).

The last bearish candle or small zone before this break becomes the Bullish Mitigation Block.

How to Identify a Bullish Mitigation Block (Step-by-Step)

Higher Timeframe (HTF):

Price hits a major support or demand zone.

Lower Timeframe (LTF):

Price forms LL → LH (bearish structure)

LH fails to create a new LL

Price breaks above the LH → BOS occurs

The price pulls back into the zone between:

The broken LH, and

The Higher Low (HL) formed after BOS

This area = Bullish Mitigation Block

What This Zone Means

Traders who sold late in the downtrend are trapped and reduce losses.

Smart Money uses this zone to mitigate earlier sell positions and initiate buy orders.

In a chart

| Type | Trend Ending | Key Failure | Breaks | Mitigation Block Zone |

|---|---|---|---|---|

| Bearish MB | Uptrend | Fails HH | Breaks HL | Between Broken HL and LH |

| Bullish MB | Downtrend | Fails LL | Breaks LH | Between Broken LH and HL |

Mitigation Blocks are extremely powerful because they combine:

Structure shifts

Liquidity traps

Smart Money order mitigation

High-probability entry zones

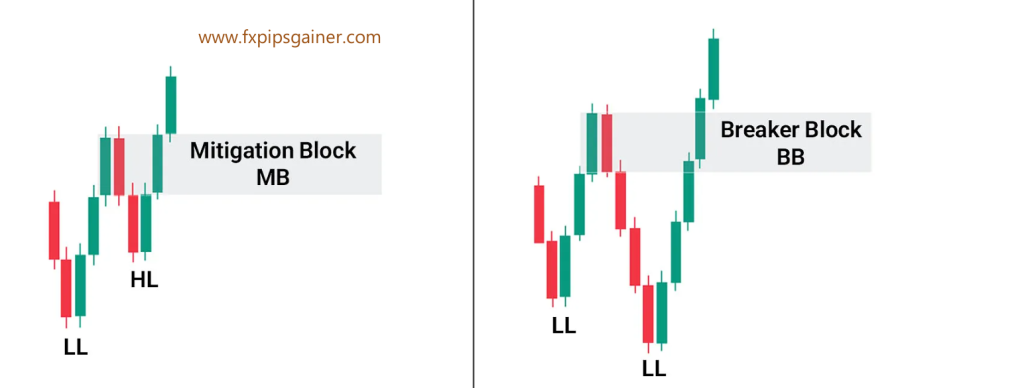

✅ Difference Between Mitigation Block and Breaker Block

Mitigation Blocks (MB) and Breaker Blocks (BB) are both reversal concepts used in Smart Money Concepts (SMC). They may look similar, but they form for different reasons and behave differently in the market.

Below is a simple explanation to help your website visitors understand the key differences:

🔹 1. Functionality

Mitigation Block (MB)

A Mitigation Block is a zone where Smart Money clears or settles orders before changing the price direction.

It acts like a processing zone where the market fills leftover buy/sell orders, and then reverses or continues with the new move.

In simple words:

👉 It’s where big players “mitigate” their previous positions before moving the market the other way.

Breaker Block (BB)

A Breaker Block forms when price breaks a previous high or low and confirms the start of a new trend.

After this break, the market returns to that zone to use it as a support or resistance.

In simple words:

👉 It’s the zone that gets “broken” during a trend shift and then becomes the new reference area.

Ins

🔹 2. Market Structure Behavior

Mitigation Block (MB)

Price fails to make a new high (in an uptrend) or fails to make a new low (in a downtrend).

This failure shows weakness, and the trend begins to shift.

The Mitigation Block forms from the last opposing candles before the structure break.

Easy explanation:

👉 Price tries to continue the trend but cannot, so it reverses and creates an MB.

Breaker Block (BB)

Price breaks the previous high or low decisively.

This break confirms a market structure shift (MSS/BOS).

The zone that gets broken becomes a Breaker Block and is later retested.

Easy explanation:

👉 Price successfully breaks a key level, then comes back to retest that zone as the BB.

⭐ Summary Table (Very Easy to Understand)

| Feature | Mitigation Block (MB) | Breaker Block (BB) |

|---|---|---|

| Purpose | Settles old orders before reversing | Confirms new trend after breaking major level |

| Break of High/Low? | ❌ No break — price fails | ✅ Yes — price breaks key level |

| Market Structure | Weakness → shift begins | Confirmed shift → trend continues |

| Acts As | Support/Resistance after mitigation | Support/Resistance after breakout |

Maximize your profit by copy our Trade

Recent Posts

- Golden Scalping Strategy

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

With a focus on credibility and transparency, IraqRankings.com provides users with dependable rankings for Iraq’s leading companies, best Iraqi brands, and top trusted services in Iraq. The platform uses large verified datasets and continuous audits to ensure that all information stays accurate, making it a powerful resource for anyone searching for trustworthy companies in the Iraqi market.