Maximize your profit by copy our Trade

Trading the Hanging Man with Moving Averages

Using moving averages in conjunction with the Hanging Man candlestick pattern can provide a solid strategy for trading downward trends. This approach focuses on identifying pullbacks to the moving average during a downtrend, allowing for potential short entries.

Step-by-Step Guide

1. Identify the Downtrend

Confirm the Trend: First, ensure that the market is in a downtrend. You can identify a downtrend by:

- Observing lower highs and lower lows in price action.

- Using a moving average (e.g., 50-period or 200-period) to confirm that the price is below the moving average.

2. Wait for the Price to Hit the Moving Average

Monitor Price Movement: As the price continues to decline, watch for it to retrace upwards towards the moving average. This pullback is critical for your entry strategy.

Look for Resistance: The moving average often acts as a dynamic resistance level during a downtrend.

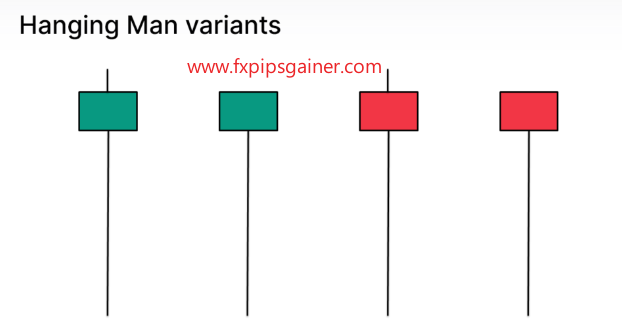

3. Check for the Hanging Man Pattern

Identify the Pattern: As the price approaches the moving average, look for the formation of the Hanging Man candlestick pattern:

- Ensure the candle has a small body.

- Look for a long lower wick.

- The upper wick should be minimal or non-existent.

4. Enter the Trade

Short Position Entry: Once you confirm the Hanging Man pattern at the moving average, prepare to enter the trade:

- Trigger: Place a sell order when the price breaks below the low of the Hanging Man candle. This signals a potential continuation of the downtrend.

5. Set Your Stop Loss

Manage Your Risk: Protecting your capital is crucial when trading:

- Stop Loss Placement: Set your stop loss just above the high of the Hanging Man candle. This provides a buffer against unexpected price movements.

6. Determine Your Take Profit Levels

Profit Target: Before entering the trade, establish your exit strategy:

- Target Levels: Set your take profit at previous support levels or based on a favorable risk-reward ratio that fits your trading plan.

7. Expect Another Leg to the Downside

Monitor Price Action: After entering the trade, keep an eye on the price movement:

- Look for subsequent bearish candles confirming the downtrend.

- Adjust your stop loss to secure profits as the market moves in your favor.

Trading the Hanging Man pattern in conjunction with moving averages can be a powerful strategy for capturing bearish reversals during pullbacks in a downtrend. By following these steps, you can enhance your trading effectiveness and manage risk appropriately.

Recent Posts

- Golden Scalping Strategy

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)