Maximize your profit by copy our Trade

Step One: Identify a Trend

- Use Multiple Time Frames: Analyze the 4-hour and 1-hour charts.

- Draw Trend Lines: Connect at least three points of resistance or support.

- Confirm Trend: Ensure the analysis shows an upward, downward, or sideways trend.

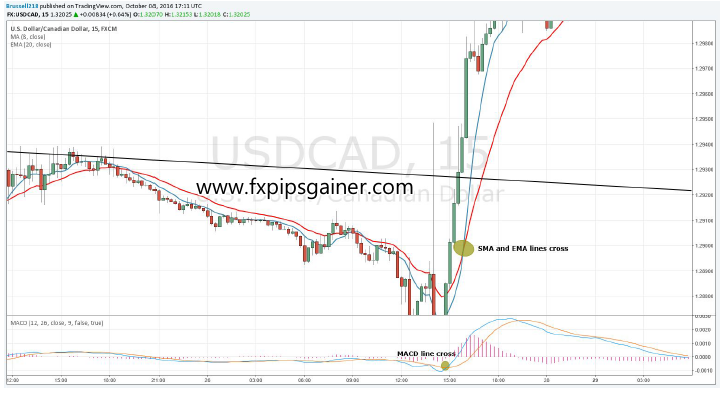

Step Two: Identify a Breakout Point

- Monitor the 15-Minute Time Frame: Focus on a tighter view to spot breakouts.

- Use Indicators: Watch for MACD and SMA/EMA crossovers.

- Wait for Candlestick Confirmation: Ensure candlesticks close above or below the trend line before proceeding.

Step Three: Identify a Point of Entry

- Confirm Entry Criteria:

- SMA must cross below EMA.

- MACD lines must cross.

- Price must break the trend line.

- Wait for Candle Confirmation: Look for at least three candlesticks to close above/below the trend line.

- Execute Trade: Enter the position based on these confirmations.

Step Four: Determine Where to Place a Stop Loss

- Identify Support and Resistance: Use the 15-minute time frame to find levels.

- Place Stop Loss: Set it below the last support level for bullish trades (or above resistance for bearish trades).

- Rationale: Protect against adverse market moves.

Step Five: Exit Rules

- Calculate Your Risk: Determine the number of pips from entry to stop loss.

- Set Reward Target: Multiply risk by 3 for the take-profit target.

- Execute Exit: Close the position when the target is reached to lock in profits.

This systematic approach combines trend analysis, indicator usage, risk management, and exit strategy, enhancing the probability of successful trades.

Trading Example:

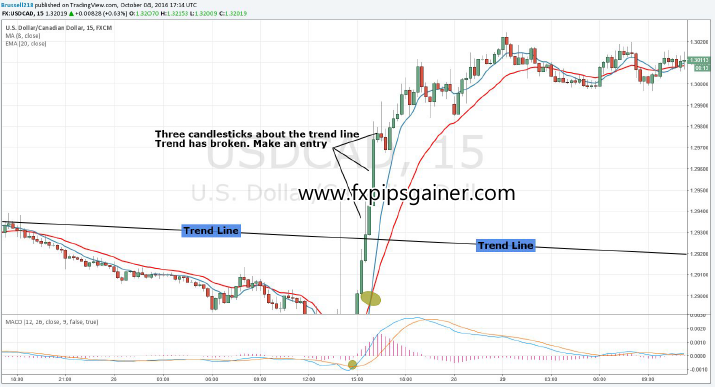

Example #1: Uptrend Break

Scenario Overview

- The trend was identified with three levels of support.

- Indicators crossed before the trend line, signaling a potential reversal.

Trade Setup

- Entry Criteria:

- Three candlesticks closed below the trend line after confirming the breakout.

- Since the uptrend has broken, you will sell this trade.

- Placing the Trade: Enter the trade immediately after the three candlesticks closed below the trend line.

Stop Loss Placement

- Based on the rules, set your stop loss above the last point of resistance. This protects against adverse movements and follows the established trading strategy.

Risk/Reward Calculation

- Calculate the risk based on the distance from your entry point to the stop loss.

- Given the setup, the trend did indeed break downward, resulting in a profit of +35 pips.

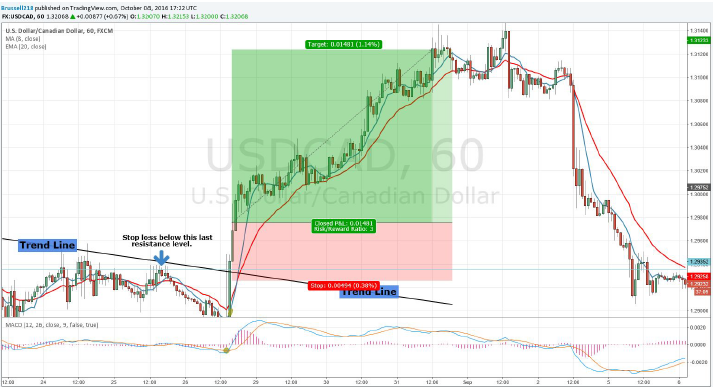

Example #2: Sideways Trend Break

Scenario Overview

- Identified a sideways trend with three levels of resistance on the 1-hour time frame.

- Indicators crossed before the trend line, indicating a possible trend break.

Trade Setup

- Entry Criteria:

Stop Loss Placement

- Set your stop loss based on the rules, ensuring it is placed comfortably below the last point of resistance.

Risk/Reward Calculation

- Calculate your risk using the distance from the entry point to the stop loss.

- This trade was a profit of +148 pips!