Maximize your profit by copy our trade

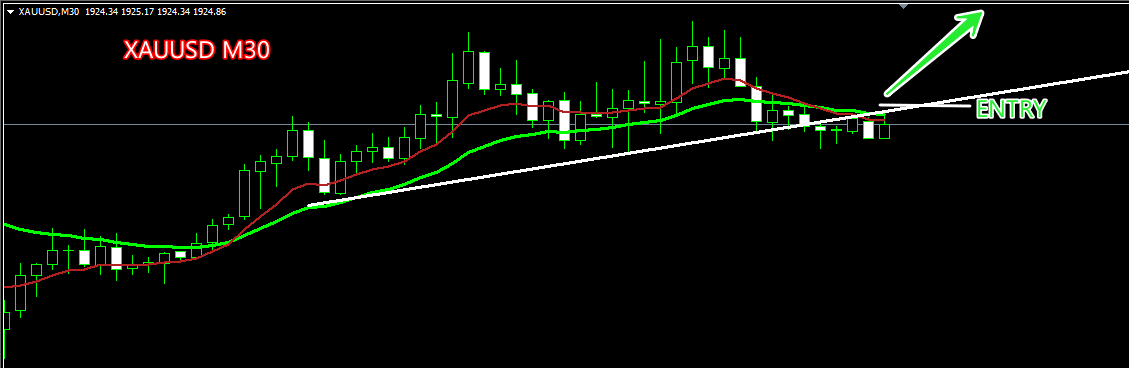

Time Frame: M30

Currency Pair: EUR/USD,USDCHF,GBPUSD,AUDUSD,USDCAD,XAUUSD,NZDUSD,

Indicators:

9 Exponential Moving Average (EMA)

20 Exponential Moving Average (EMA)

Rules:

1.Setup your chart:

Open a chart on MetaTrader 4 platform.

Select the M30 time frame.

Add the 9 EMA and 20 EMA to the chart.

2.Identify a downward trending currency pair:

Look for a currency pair that is trending downward, with lower lows.

In this example, we are using EUR/USD.

3.Draw a trend line:

Draw an upper trend line to connect the highs of the downward trend.

4.Entry:

Wait for a candle to close above both the 9 EMA and 20 EMA after the trend line break.

Enter a BUY trade at the close of this candle.

5.Set a stop loss:

Place a stop loss below both the 9 EMA and 20 EMA.

6.Set a take profit target:

Aim for a 2:1 risk-to-reward ratio.

For example, if the stop loss is set at 20 pips, set a take profit target at 40 pips.

Take profit when the price levels out and continues to touch the bottom 20 EMA.

To enter a short trade using the trend breakout strategy, you would follow these steps:

1. Setup your chart:

– Open a chart on MetaTrader 4 platform.

– Select the M30 time frame.

– Add the 9 EMA and 20 EMA to the chart.

2. Identify an upward trending currency pair:

– Look for a currency pair that is trending upward, with higher highs.

– In this example, we will continue using EUR/USD.

3. Draw a trend line:

– Draw a lower trend line to connect the lows of the upward trend.

4. Entry:

– Wait for a candle to close below both the 9 EMA and 20 EMA after the trend line break.

– Enter a SELL trade at the close of this candle.

5. Set a stop loss:

– Place a stop loss above both the 9 EMA and 20 EMA.

6. Set a take profit target:

– Aim for a 2:1 risk-to-reward ratio.

– For example, if the stop loss is set at 20 pips, set a take profit target at 40 pips.

– Take profit when the price levels out and continues to touch the top 20 EMA.

Remember, it is crucial to practice this strategy on a demo account and adapt it to your own trading preferences. Additionally, consider market news and avoid trading during volatile news releases.

Trade Now

Hello to every one, it’s actually a pleasant for me to go to see this web site, it includes valuable Information.