Maximize your profit by copy Our Trade

Do you want to master the ICT Reclaimed Order Block to enhance your trading precision and understand how institutional traders manipulate the market?

Reclaimed Order Blocks (ROBs) are one of the most powerful concepts in ICT (Inner Circle Trader) methodology — deeply rooted in the Market Maker Model (MMBM & MMSM). Understanding this theory can significantly improve your grasp of smart money concepts (SMC) and price behavior.

🧠 What is an ICT Reclaimed Order Block?

A Reclaimed Order Block is a specific zone on the chart where institutional traders or smart money previously accumulated large buy or sell orders.

Initially, these areas show minor displacement (a small reaction or move in price), indicating institutional activity. Later, when price revisits this area, the same block is reclaimed — turning into a strong support or resistance zone.

This reclamation reveals where liquidity was engineered and institutional positions were built. When reclaimed, these zones often act as the foundation for the next strong directional move.

📈 Understanding Market Curves: Buy Side & Sell Side

According to ICT’s market structure model, the market moves like a curve — it has two primary sides:

Buy Side of the Curve: Where price seeks liquidity above previous highs.

Sell Side of the Curve: Where price seeks liquidity below previous lows.

Institutions accumulate buy orders on the sell side and sell orders on the buy side — allowing them to build positions before driving price in the opposite direction.

🧩 Reclaimed Blocks in the ICT Market Maker Models

To fully understand Reclaimed Order Blocks, you must know the two ICT Market Maker Models:

1. Market Maker Buy Model (MMBM)

The market first moves down to the sell side of the curve to collect liquidity.

Institutions accumulate buy positions during this phase.

These zones often form Bullish Reclaimed Order Blocks — the foundation for the next upward move.

2. Market Maker Sell Model (MMSM)

The market first moves up to the buy side of the curve to collect liquidity.

Institutions accumulate sell positions here.

These zones create Bearish Reclaimed Order Blocks — the launching point for a downward move.

Trade Now

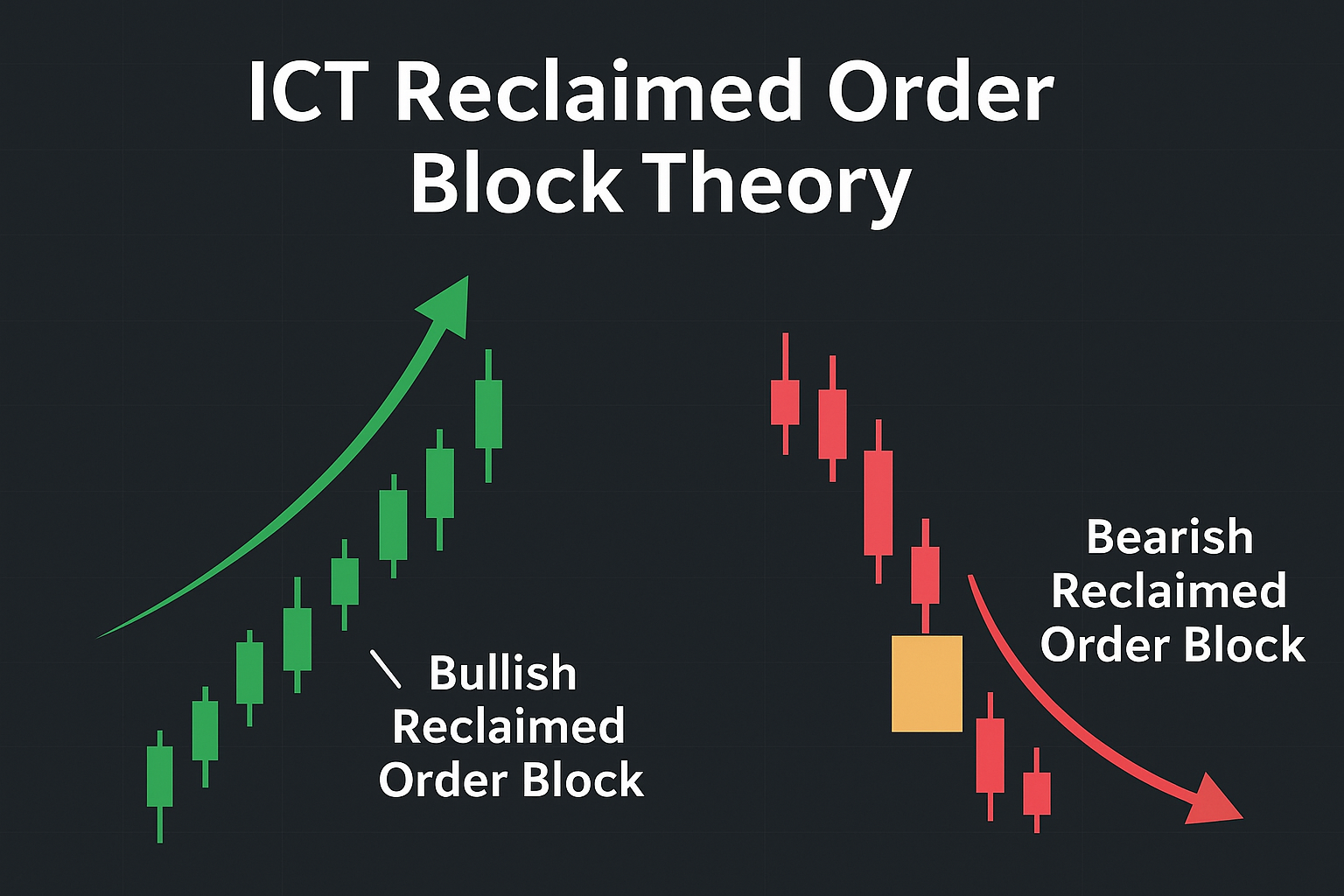

💎 ICT Bullish Reclaimed Order Block Explained

A Bullish Reclaimed Order Block is the last down-close candle (bearish candle) before a minor upward displacement occurs.

How it works:

It appears on the sell side of the curve during a bullish market structure.

Smart money begins accumulating buy positions while retail traders are still selling.

When price shifts momentum upward, it reclaims the previous order block, which then acts as support.

The reclaimed zone becomes a launching pad for the next bullish leg.

Example Behavior:

Price moves down to sweep liquidity below a previous low.

Institutions execute buy orders within the old bearish candle zone.

Price reverses, displacing upward and reclaiming that area.

On the retest, price respects the reclaimed order block — confirming smart money accumulation.

🔻 ICT Bearish Reclaimed Order Block Explained

A Bearish Reclaimed Order Block is the last up-close candle (bullish candle) before a minor downward displacement occurs.

How it works:

It appears on the buy side of the curve during a bearish market structure.

Institutional traders start accumulating sell orders as retail traders chase buying breakouts.

When price shifts downward, it reclaims the bullish candle area, which now acts as resistance.

This reclaimed zone becomes the launchpad for the bearish move.

Example Behavior:

Price moves up to sweep liquidity above a previous high.

Smart money executes large sell orders in that bullish candle.

Price declines sharply, confirming displacement.

When revisited, the reclaimed zone acts as resistance, pushing price lower.

⚙️ How to Identify a Valid Reclaimed Order Block

Before taking trades, ensure these confirmations are in place:

✅ Clear Market Structure — Identify if price is in a buy or sell model phase.

✅ Liquidity Sweep — Look for stops taken above/below previous highs/lows.

✅ Minor Displacement — A short, sharp move that shows market reaction.

✅ Retest & Reaction — Price must return and react to the reclaimed block.

✅ Higher Timeframe Alignment — Confirm with PD Arrays (Premium/Discount Arrays).

💡 Practical Example Summary

| Type | Found On | Candle Type | Institutional Action | Later Role |

|---|---|---|---|---|

| Bullish Reclaimed OB | Sell Side of Curve | Last Down-Close | Accumulating Buys | Support |

| Bearish Reclaimed OB | Buy Side of Curve | Last Up-Close | Accumulating Sells | Resistance |

⚠️ Does Every ICT Reclaimed OB Work?

No — not every reclaimed block is tradable.

Always wait for:

Confluence with liquidity sweeps

Higher timeframe PD array confirmation

Lower timeframe entry confirmation

And never risk more than 1% of your trading capital per setup.

🧭 Final Thoughts

The ICT Reclaimed Order Block is a cornerstone concept in understanding how institutions engineer liquidity and manipulate price.

It bridges the gap between order flow, liquidity theory, and directional bias — allowing traders to align with smart money behavior rather than retail traps.

However, no strategy guarantees success. Markets are dynamic, and risk management should always be your priority.

💬 “Market moves lower to move higher, and higher to move lower.” — ICT

By mastering the concept of Reclaimed Order Blocks, you’ll gain powerful insights into institutional footprints and learn to trade in harmony with the true drivers of price.

Recent Posts

- Golden Scalping Strategy

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

Recent Posts

- Golden Scalping Strategy

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)