Maximize your profit by copy Our Trade

Trading System Overview

This trading system features two entry types: conservative and aggressive. Both can yield great results if used correctly.

Recommended Timeframes

- M5 (5 minutes)

- M15 (15 minutes)

- H1 (1 hour)

- H4 (4 hours)

Entry Types

1. Conservative Entries

- Confirmation Required: Align with the direction indicated by the text on the chart.

- Long Trades: Wait for “Trend Ʌ” confirmation.

- Short Trades: Wait for “Trend ∇” confirmation.

2. Aggressive Entries

- Less stringent criteria: Enter trades without the strict confirmation from the chart text.

Maximize your Profit by copy our Trade

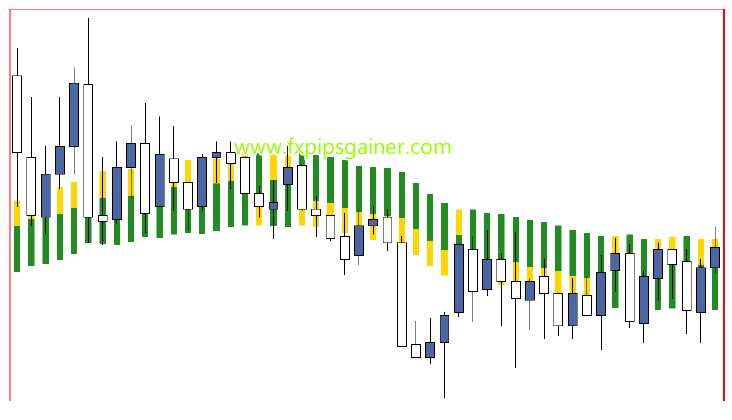

Long Entry Trades

- Indicator Confirmation:

- Wait for 2-3 Yellow lines to be on top of the indicator.

- Price Action:

- If the price is above the indicator: Wait for a retracement to the indicator.

- If the price is below the indicator: Wait for the first bar to close above or very close to the indicator.

- Trend Confirmation:

- For conservative entries, ensure the text says “TREND UP” (refer to the image on the right).

- Candle Closure:

- Wait for a bull candle to close above the indicator.

- Entry Placement:

- At the open of the next candle, if the yellow line remains on top of the indicator, place the entry.

- Stop Loss and Take Profit:

- Place your Stop Loss 2-3 pips below the indicator or swing low point (whichever is closer).

- Your Take Profit should be 1.5 times your Stop Loss value. For example, if your Stop Loss is 10 pips, then your Take Profit should be 15 pips.

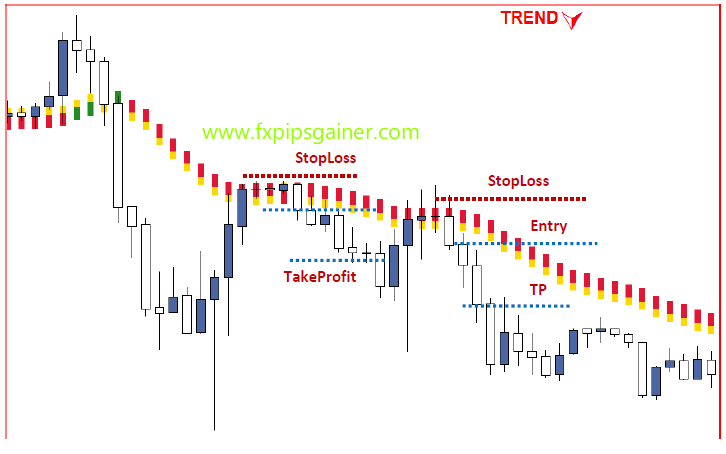

Short Entry Trades

- Indicator Confirmation:

- Wait for 2-3 Yellow lines to be on the bottom of the indicator.

- Price Action:

- If the price is below the indicator: Wait for a retracement to the indicator.

- If the price is above the indicator: Wait for the first bar to close below or very close to the indicator.

- Trend Confirmation:

- For conservative entries, ensure the text says “TREND DOWN” (refer to the image on the right).

- Candle Closure:

- Wait for a short candle to close below the indicator.

- Entry Placement:

- At the open of the next candle, if the yellow line remains on the bottom of the indicator, place the entry.

- Stop Loss and Take Profit:

- Place your Stop Loss 2-3 pips above the indicator or swing high point (whichever is closer).

- Your Take Profit should be 1.5 times your Stop Loss value. For example, if your Stop Loss is 10 pips, then your Take Profit should be 15 pips.

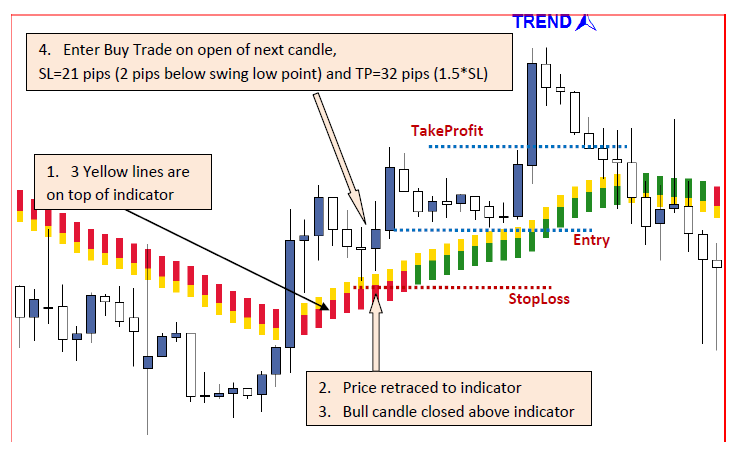

Long Entry Example:

- Initial Price Movement:

- The price moves above the indicator.

- Yellow Line Confirmation:

- Wait for 2-3 yellow lines to appear on top of the indicator.

- Retracement:

- Wait for the price to retrace back to the indicator area.

- Candle Closure:

- Look for a bull candle to close above the indicator.

- Entry Point:

- Enter a buy trade after the bull candle closes.

- Stop Loss Placement:

- Place your Stop Loss below the closest swing point. This should be closer than the area from the bottom of the indicator.

- Take Profit Calculation:

- Set your Take Profit at 1.5 times your Stop Loss value.

- Risk Management:

- Risk 1% per trade; consider a maximum of 2-3% for long-term trading success.

- Only risk more if you are aware of the potential consequences.

- Trend Observation:

- Note the downtrend before the trade. This trend changed to an uptrend before point 1.

- Recognize that there was another attempt to break the indicator around 10 bars before the identified point, indicating a potential trend change.

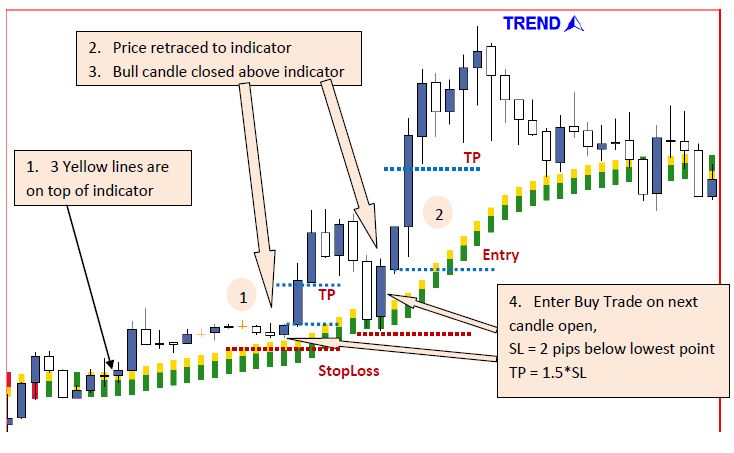

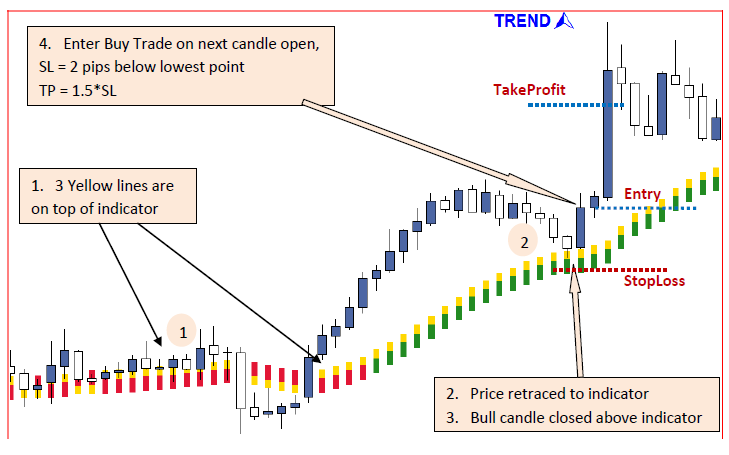

Another one Long entry Example

Conservative Rules

Following conservative trading rules would help you avoid Entry #1. Notice that the price did not significantly move away from the indicator, indicating market indecision.

Advice for Beginners

If you are a beginner, it’s advisable to:

- Wait for the price to move away from the indicator.

- Then, look for a retracement back to the indicator.

Over time, you will learn to identify signs of market indecision, enhancing your trading skills and decision-making.

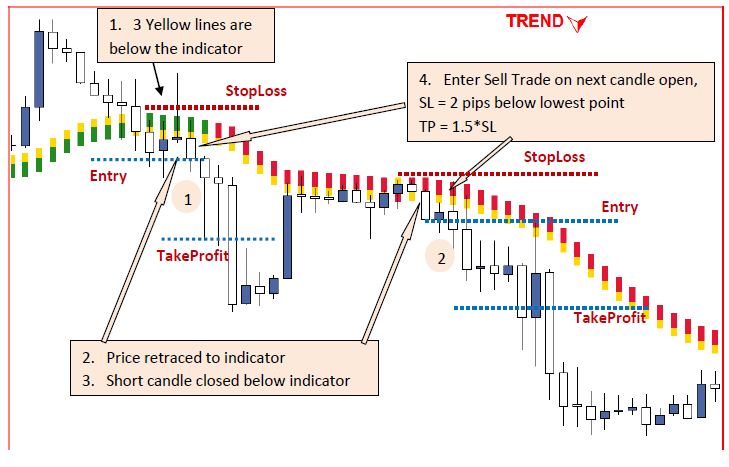

Short Entry Example

In the above example, we have 2 potential entries.

- If you follow conservative rules and wait for the trend to be down, you will only enter Entry #2.

Key Considerations

The main thing to keep in mind is:

- Look for a nice retracement of price back to the indicator.

- Wait for a short candle to close below the indicator. This is often a strong confirmation that the market is moving in the right direction.

Next Steps

In the next example, we will not comment on the entries, allowing you to analyze for yourself how the entry decision was made.

Choppy Market Caution

Tips for Successful Trading: Step-by-Step

1. Avoid Entering a Choppy Market

- If the market is not stable or there are upcoming news events that could affect your currency pair, avoid entering the market.

- Use resources like forexfactory.com to check for upcoming news.

- As you gain experience, you’ll learn to “feel” when to avoid trading.

- Rule of thumb: If you have 2-3 losses in one day, stop trading for the rest of the day to let your brain cool down.

- Remember that trading is about rules and psychology; emotional trading can lead to irrational decisions.

2. Waiting in a Ranging Market

- If the market is ranging, wait for the price to break the range by at least 5 pips before entering.

- You can enter the market right away without waiting for a candle close.

3. Limit Trades in the Same Direction

- Do not take more than 2 trades in the same direction after the market has changed.

- For example, if the market changes from a downtrend to an uptrend and you successfully take 2 buy trades, refrain from further trades in that direction.

- Wait for the market to range or change direction before entering again.

4. Manage Risk Effectively

- Risk only 1-2% of your capital per trade. This is the most profitable and stable money management strategy in the long term.

- Remember that risking more makes it significantly harder to recover your account.

5. Recognize Market Conditions

- If the market is choppy, it may indicate a range or indecision.

- In such scenarios, avoid entry and take the day off.

- Spend quality time elsewhere; opportunities will arise the next day.

6. Timing Your Trading Sessions

- Timing is crucial for successful trading.

- There’s no need to be awake 24 hours to maximize profits.

- Focus your trading during the main sessions, such as London and New York.

The best timeframes are M5, M15, H1, H4, and Daily. You can trade this system on major currency pairs like EurUsd, GbpUsd, UsdJpy, UsdChf, AudUsd, and NzdUsd. Always try it first on a demo account to see how it works for you.

To change any parameters, right-click on the chart, go to Indicator List, select ProEMAGain, and click Edit. After making changes, click OK.

Yes, when you install the indicator, it includes two templates: one for White Background charts and one for Black Background charts. They are located in Charts → Template and are called ProEMAGain_BlackBg and ProEMAGain_WhiteBg. Just apply them to your chart.

You can apply ProEMAGain to as many charts as you want; there are no limitations.

No, ProEMAGain is an indicator and will not enter trades for you.

To uninstall, go to the Indicator List, select ProEMAGain, and click Delete. It will remove the indicator from your charts.

Ensure that the indicator is properly installed and that you are using the correct timeframe. Restart the trading platform if necessary.

ProEMAGain is designed for specific platforms. Check the compatibility with your trading software before installation.

Right-click on the chart, go to Indicator List, select ProEMAGain, and click Edit. From there, you can reset the parameters to their default values.

It’s recommended to check for updates regularly, as improvements and bug fixes are often released. Ensure you have the latest version for optimal performance.

Surface ultrastructural characteristics of BB 88 cells treated with or without tamoxifen as depicted buy generic priligy