The Bearish Falling Three is a bearish candlestick pattern that typically forms during a downtrend and indicates a potential continuation of the downward move. It is considered a reliable pattern, especially when combined with other technical analysis tools and indicators.

The Bearish Falling Three pattern consists of the following characteristics:

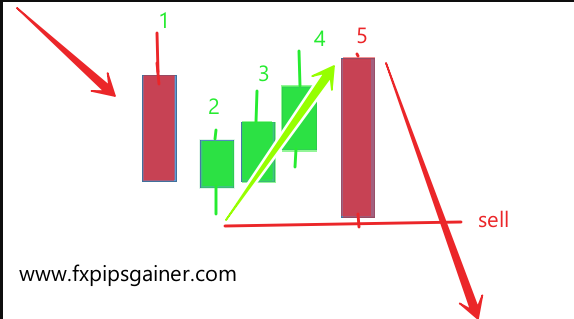

1. Existing Downtrend: The market should be in a downtrend before the pattern occurs, indicating that sellers are in control.

2. First Candle: The first candle is a long bearish (red) candle, which signifies a continuation of the existing downtrend.

3. Second, Third, and Fourth Candles: These candles are small-bodied, typically green or red, and they trade within the range of the first candle. They represent a temporary pause or consolidation in the downward move.

4. Fifth Candle: The fifth candle is another long bearish (red) candle that closes below the lows of the previous four candles. It confirms the continuation of the downtrend and suggests that sellers have regained control.

The pattern is called the “Falling Three” because the small-bodied candles in the middle resemble a falling flag or pennant formation.

Traders and analysts often use the Bearish Falling Three pattern as a signal to enter or add to short positions, as it indicates a high likelihood of the downtrend continuing. However, it’s important to consider other technical factors and confirm the pattern with additional indicators or analysis before making trading decisions.

Sell opportunity: