Maximize your profit by copy Our Trade

Money management and risk management are key aspects of trading with supply and demand zones.

There is nothing more important than having the right money management skills. For a full article on money management, you can visit this page, where I talk about it extensively.

For the sake of this article, I would just share with you that no matter how appealing a trade looks like, you should always abide to your trading rules.

No exceptions!

No second chances!

Just the right amount of risk per trade.

I have detailed a whole system of how to properly manage your risk. It is part of my trading course, so if you are interested, you can pay it a visit. I usually like to minimize risk while increasing the return possibility and the system I have built does help me in that a lot!

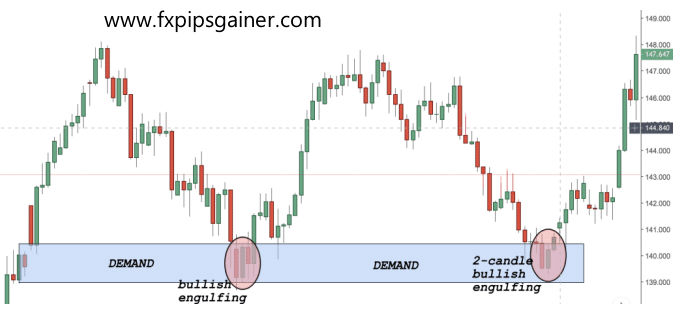

Let’s continue with another example of supply zones and price action.

What you need to consider when trading with supply and demand zones is that the reliability of a signal is often in a direct relationship with its frequency. In other words, the less often a certain pattern occurs, the higher its reliability could be.

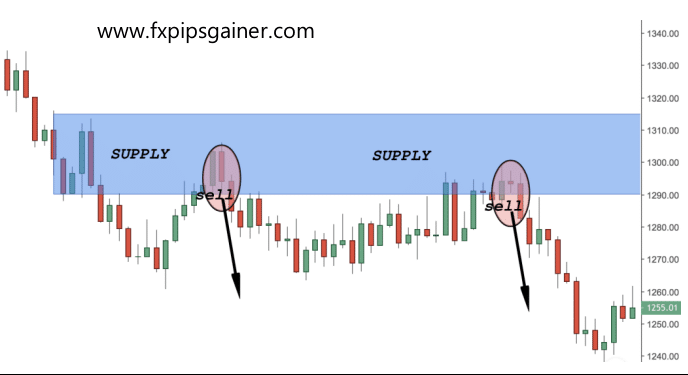

Let’s have a look at another supply zone example with price action.

In this example above, I have chosen a supply zone that is in the middle of a range. As you can see, it is as powerful as if it was in the extremities of a range.

– The first sell trigger came when price action printed a two-candle bearish engulfing pattern.

– The second sell-trigger came when price printed another two-candle bearish engulfing

pattern.

It usually takes more experience to see a supply or demand zone in the middle of a range than to spot it at the extremities. One way or another, location is less important than the zone itself.

It does not really matter where it forms, as long as it forms.

Maximize your profit by copy Our Trade

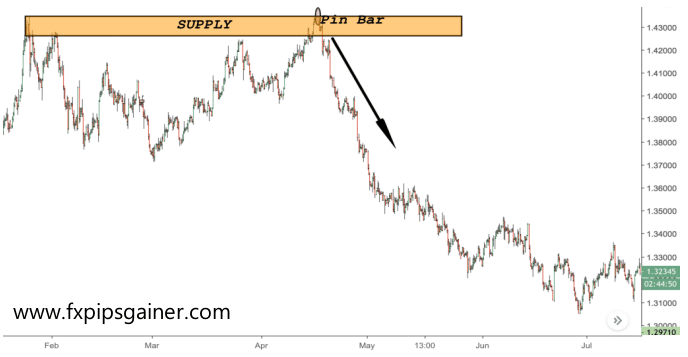

In this example above you see a potential trading setup that would have given almost 1:6

risk:reward ratio just from a daily chart point of view.

Considering that you can fine-tune your entry from the 4H chart, this could have been an even

bigger winner.

As you can see from the charts above, this could have been one unbelievable trade if you followed those rules. I managed to take this trade and stayed within it for quite some time. It is extremely hard to hold onto this trade until the very end, but even with a fraction of this move, you could have made a fortune.

Let’s try to look into a potential risk: reward scenario if you have managed to stay for the duration of the whole move:

This incredible 1:35 risk:reward ratio is almost unbelievable!

Even if you managed to stay in this trade for just 1/3rd of the move, you would have made over 10 times your risk.

This return is achieved even without scaling in- just from ONE SINGLE TRADE!

I do usually use scaling in with my trading strategy, which would have magnified the trading

results!

The beauty of my trading strategy is that it also helps you stay away from unprofitable trades by minimising the effect of the losing trades.

All in all, trading a combination of supply and demand zones with price action does really perform spectacularly well.

Maximize your profit by copy Our Trade

Recent Posts

- Golden Scalping Strategy

- How to Trade Supply and Demand Zones in Forex Using SMC Strategy

- Binary Trading vs Forex: Gambling or Real Business?

- Professional Copy Trading Service Using Real Money Accounts

- Why You Should Avoid Sell Entries in Gold Trading

- Safe Gold Trading Strategy for XM Micro Accounts (Up to 12 Entries)

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)