Maximize your Profit by copy our Trade

This tutorial begins a series of how to apply Elliott wave analysis for practical trading strategies. All subscribers have some Elliott wave background from my Dynamic Trading book. Because that book goes through the pattern structures in detail, there is no need to repeat that information in this tutorial series.

It is assumed for this series, that subscribers are familiar with Chapter 3 of Dynamic Trading and how the most frequent pattern subdivide.

Besides teaching you the practical application of Elliott wave trading strategies, an objective of this series will also be to dispel some Elliott wave myths and bad practices fostered by Elliott wave academics.

Everything taught in this tutorial series will apply to any actively traded market included futures, stocks, indexes and mutual funds and any time frame whether five-minute or monthly.

What You Should Know Before Beginning This Tutorial Series

From your study of Elliott wave in Chapter 3 of Dynamic Trading, you should be familiar with these concepts.

Impulse Trend – Usually unfolds in five-waves. Five-wave impulse trends are usually made in the direction of the larger degree trend.

Counter-Trend – Usually unfolds in three-waves. A counter-trend is a correction to the prior impulse trend.

Waves of Similar Degree – Also called swings of similar degree. Waves of similar degree represent the subdivisions that make up a completed structure. In an impulse trend, waves one-five are the waves of similar degree. The subdivisions of each wave are waves of a smaller degree.

Subdivisions of a Wave – Any given wave may subdivide into smaller degree waves to complete the structure of the wave. For instance, Wave-1 of a five-wave impulse trend usually subdivides into five waves of lesser

degree. You should be familiar with how each wave of a trend or counter- trend usually subdivides.

Multiple Time Frames – Multiple Time Frames has become a buzz- phrase recently. It is nothing more than R.N. Elliott’s approach to considering multiple degrees of wave structure. When the subdivisions of a wave are complete, the larger degree wave is compelte.

Trend or Counter-Trend?

What is Elliott Wave Analysis?

Elliott’s Wave Principle is a catalogue of defined chart patterns. These patterns are helpful to indicate if the market is in a trend or counter-trend. Knowing the trend or counter-trend position, we also know the main trend direction. Each pattern has implications regarding the position of the market and the most likely outcome of the current position.

Most pattern positions will have an outcome that will validate or invalidate the assumed pattern position. This is extremely important. It also helps us to determine the maximum distance away from the market to place the protective stop-loss.

Elliott Wave Pattern Basics – 5’s and 3’s

The basis of Elliott’s Wave Principle is that most trends unfold in five waves in the direction of the trend and three waves or combinations of three waves in the direction counter to the main trend. It’s that simple. Markets usually unfold in three’s and five’s. Five wave patterns are impulsive or trend structures. Three wave patterns are corrective or counter-trend structures.

A five-wave impulse trend and three wave or more complex counter- trend each has a characteristic structure which we will talk about continually throughout this tutorial series. One important objective of Elliott wave analysis is to recognize in the early stages of the wave structure whether it is more likely to be an impulse or a counter-trend.

The Three Elliott Wave Rules

These three rules are most relevant to daily closing data.

- Wave-2 should not exceed the beginning of Wave-1. In other words, Wave-2 should not make greater than a 100% retracement of Wave-1.

- Wave-3 should not be the shortest of the three impulse waves in a five-wave impulse trend (waves 1, 3 and 5).

- Wave-4 should not make a daily close into the closing range of the Wave-1.

These rules are extremely helpful to confirm or invalidate a potential pattern. Even when using intraday data, be aware of the pattern and guidelines relative to the daily closing data.

Why is pattern analysis an important part of the Dynamic Trading approach to technical analysis?

- Pattern analysis helps us to determine if a market is in a trend or counter-trend.

- Pattern analysis helps us to determine the position of the market within a trend or counter-trend.

- Pattern analysis helps us to project the time and price objectives of the current trend or counter-trend.

Think Pattern

Below we will go through several pattern examples. The objective is to learn to think in terms of pattern position and what a market must do to confirm or invalidate a particular pattern structure. Every potential pattern position cannot be illustrated, but if you keep the basic pattern concepts and guidelines in mind, you will be able to identify the potential pattern position for most market situations.

Here is a quick review of what we are trying to accomplish with pattern analysis.

The Three Pattern Questions

- What is the most probable pattern position? Why? The answer to this question may only be “impulsive” or “corrective.” The answer may also be, “don’t ”

- What market activity will confirm the assumed pattern position? What is the pattern guideline that is relevant?

- What market activity will invalidate the assumed pattern position? What is the pattern guideline that is relevant?

The Three Important Pattern Considerations

- Be quick to admit when there is no discernable or relevant pattern! Do not force an Elliott Wave count when there is no count that meets the guidelines or a clearly defined five or three wave

- If there is no discernable wave count, does the pattern appear to be in an impulse or corrective structure?

- As new data is made, the market will continually confirm or invalidate the pattern position Trade the market, not the forecast. Be quick to change your assumption of the pattern position if the market activity invalidates the current assumption.

What’s Next?

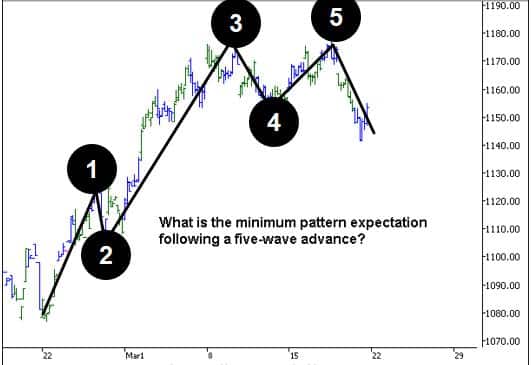

If a five-wave trend is complete as shown below, what is the minimum pattern we should expect?

Regardless of how this five-wave pattern fits into the larger degree pattern position, at least a three wave decline should be expected. The minimum expectation is for a three-wave ABC correction. This may not unfold but if pattern is to be useful, we must begun with a high-probability assumption and let the market confirm or invalidate that assumption.

If this five-wave trend completed a larger degree five-wave trend, a five-wave decline may follow but the minimum expectation would still be a three-wave.

We always assume a correction will be a three-wave, ABC even though it may take many shapes.

Trend or Counter-Trend?

What should we anticipate after the low in mid-March below – a counter- trend rally or an impulse trend eventually to a new high?

There is not enough data to give a high-probability answer. The decline shown above is clearly an impulse trend. The position of that impulse

trend within the larger degree trend will help determine what next to expect.

If the decline is a W.1, A or 3, we would expect a counter-trend rally (W.2 or B or 4) followed by the continuation of the bear trend to a new low.

If the decline is a W.C, we would expect a continuation of the bull trend to a new high.

If the decline is a W.5, we would expect a larger degree counter-trend rally. The first rally would typically subdivide into five-waves since a W.A is typically five-waves.

Whether the rally is a trend or a counter-trend, we would anticipate at least a three-wave rally (ABC or 123). The position within the larger degree trend will help to determine what to ultimately expect.

Count Backwards

What’s the pattern of this advance? It definitely doesn’t fit a typical five or three wave pattern. To help determine what a pattern may be, it is helpful to have a firm idea of what is the pattern position of the last major pivot.

If the low in March is a Wave 1 or A, then the rally should be a correction. We initially assume any correction is going to be an ABC until proven otherwise. This data is up through the date of this tutorial.

Nowhere along the way of this correction did it unfold as a typical ABC.

Just today, bonds declined below the prior swing low which signaled the impulsive part of the rally from the late March low (labeled W.B) should be a completed pattern structure, probably a Wave-C that subdivided into five-waves. If that is the case, count backward to see if any wave count will fit. The one above is an acceptable fit within all of the guidelines of Elliott wave.

Wave-A is an impulse. Wave-B is three waves and the W.b:B is also three waves. Wave-C is five-waves. All the subdivisions fit well even though the Wave-C is out-of-balance (much greater in time and price) than Wave-A.

Some times the pattern position does not clearly reveal itself until after it has signaled that it should be complete. Then we need to count backwards to see if the pieces seem to fit together within the rules and guidelines. If so, we have a basis to make an informed and high- probability trading decision with well defined and acceptable capital exposure.

Trend or Counter-Trend?

Is a 1-2-3 count the best potential for the data below? Why or why not?

The rule that was formed by for the stock indexes is Wave-4 should not make a daily close into the closing range of the Wave-3. For the data above, the potential Wave-4 has made several daily closes into the Wave- 1 closing range although the decline below the Wave-1 high is small in price. It is acceptable for a Wave-4 to close and trade slightly into the range of Wave-1 for commodities and individual stocks.

A better wave count may at first seem to be the high on the chart is a completed five-wave trend as shown below. The main drawback here is the Wave-4 is much shorter in time and price than the Wave-2 – it is out- of-balance with Wave-2. While this doesn’t rule out a five-wave count, the alternate wave count shown below where the high is a Wave-3 that cleanly subdivided into five-waves is just as good a count.

At this point in time, neither of the two wave counts is overwhelmingly favored. According to the rules and guidelines, either is acceptable. It will require more data to determine which may be best. The trader must also look to other factors such as the time, price or seasonal position to get a better idea of which wave count may be more probable.

If the five-wave count to the March high shown above is correct, beans should continue the bull trend after completing a correction to the five- wave trend.

If the alternate count is correct, beans should be in the process of completing a Wave-4 low which should be followed by a continued advance to a new high.

Which count becomes the most evident as more data is included will help to determine the extent of the next bull trend – A Wave-5 or entirely new five-wave trend.

Lessons Learned

The Three Elliott Wave Rules

These three rules are most relevant to daily closing data. They should be committed to memory.

- Wave-2 should not exceed the beginning of Wave-1. In other words, Wave-2 should not make greater than a 100% retracement of Wave-1.

- Wave-3 should not be the shortest of the three impulse waves in a five- wave impulse trend (waves 1, 3 and 5).

- Wave-4 should not make a daily close into the closing range of the Wave-1.

The Three Pattern Questions

Whenever considering an Elliott wave pattern, you should ask yourself these three questions and not consider an Elliott wave count unless you can answer all three.

- What is the most probable pattern position? Why? The answer to this question may only be “impulsive” or “corrective.” The answer may also be, “don’t ”

- What market activity will confirm the assumed pattern position? What is the pattern guideline that is relevant?

- What market activity will invalidate the assumed pattern position? What is the pattern guideline that is relevant?

The Three Important Pattern Considerations

If you are using Elliott wave for practical and logical trading strategies and decisions, these three considerations will always be in mind.

- Be quick to admit when there is no discernable or relevant pattern! Do not force an Elliott Wave count when there is no count that meets the guidelines or a clearly defined five or three wave

- If there is no discernable wave count, does the pattern appear to be in an impulse or corrective structure?

- As new data is made, the market will continually confirm or invalidate the pattern position Trade the market, not the forecast. Be quick to change your assumption of the pattern position if the market activity invalidates the current assumption.

More To Come

Each week, a new tutorial will build on what we have learned. Also, in the regular report, I will expand on the pattern comments to relate to what is being taught in the tutorials. The pattern descriptions in the report will help you to learn how pattern is considered to be part of a trading decision as a market unfolds.

Over the next few weeks, I believe you will have had the most comprehensive and practical Elliott wave pattern education available from any source. You will clearly understand how pattern can be an important factor of your trading decisions. You will also understand and how to apply Elliott wave pattern to make the high-probability time and price projections that are a key to trend targets, reversals, continuations and other trading strategies.

Maximize your Profit by copy our Trade