Maximize your profit by copy Our Trade

Supply and Demand zones do offer a great insight into the structure of any market. If you have an idea of how to trade with support and resistance zones, you might find supply and demand zones very similar. You won’t be mistaken.

Supply and demand zones are very similar if not the same. There are certain rules though that make them stand aside and IMHO shine brighter than just support and resistance. I will make sure you will find out exactly why in this article.

What are Supply and Demand zones:

So, what exactly is a supply zone and a demand zone. This would be best described by a chart

In the image above you see the German stock market DAX. The red zone is marked as a supply zone. This could also be defined as an active resistance level or a place where traders are selling huge amounts. These levels are broader than a resistance line. They are very similar to resistance zones.

On the other side, a Demand zone is a broad area of support, just like the image below.

In the chart above you can see a supply zone or in other words a very broad support level. It is also a level concentrated in buyers. As you can see every time price approaches the supply zone it quickly jumps back up.

Another characteristic of supply and demand zones is the quick price action. As pointed out above, price action is very fast around those levels, so if there are opportunities they are quickly absorbed.

Maximize your profit by copy Our Trade

Candlestick and Supply and Demand:

A very important element of supply and demand trading is the use of candlestick charts in conjunction with it.

The two most important candlestick patterns used in conjunction with supply and demand levels are the pinbar and the engulfing pattern. The majority of traders using supply and demand zones will be looking for rejections or confirmations of these levels.

Therefore, it is essential that you can recognise at least those two candlestick patterns.

– Pin Bar

– Engulfing

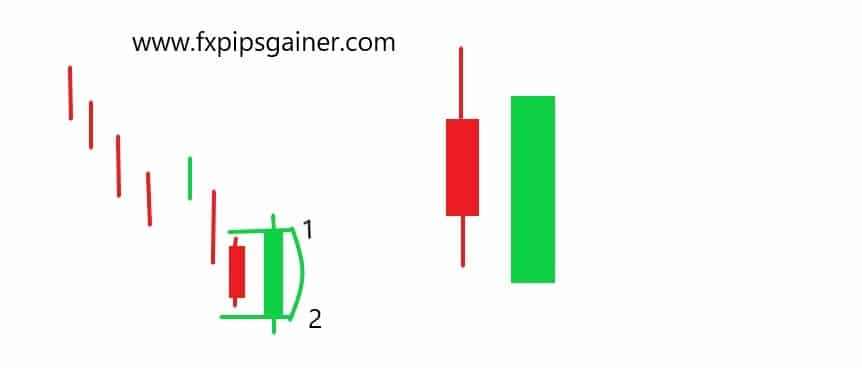

Below is given an example of them both:

In the example above, there are two candlestick patterns- Pinbar and a 2 Bullish Engulfing Pattern. As you can see from the chart above, price quickly jumps higher after those candlesticks have been formed.

Supply and Resistance Levels vs Zones:

As explained before, support and resistance levels are very similar to the zones. The only difference is that zones encompass larger area. The other difference is the way to draw supply and demand zones, but we will come to this later.

In practice, support and resistance and supply and demand zones are beasts from one and the same origin.

If that helps, you can even imagine supply and demand zones as large support and resistance areas with a huge concentration of buyers and sellers respectively.

Timeframes and Supply and Demand Zones:

The good news is that Supply and Demand zones can be used with equal success on all timeframes. I would still recommend that you use them on timeframes higher than 60 minutes. Anything below that consists of a lot of noise and more false signals.

In my experience, the best timeframes to spot supply and demand zones are the 4H and the Daily.

Maximize your profit by copy Our Trade

How to Find Supply and Demand Zones:

The best way to find supply and demand zones is to look at a candlestick chart. Here is the order of things to do to spot supply and demand zones:

1. Look at the chart and try to spot successive large successive candles. It is important that price moves a lot.

2. Establish the base (beginning) from which price started the quick move.

3. Usually, before a large move you have a small sideways move- that is where your supply and demand zone is.

Let me give you an example, so you can understand what I mean by large successive candles:

You can see in the image above that the three areas are showing areas of fast-moving price. These are exactly the type of market moves you should be looking for. Now, the question remains- how do we define the supply and demand zones.

The best way to show is through an illustration. Let me draw them, so you can better visualize:

As you can see in the image above, the demand and supply zones are encompassing the base on the beginning of the move. It is very hard to be precise with those levels and here it is more of an art than science.

The good news is that after a while you get used to spot those levels and your eye turns into an automatic scanner.

Maximize your profit by copy Our Trade

Recent Posts

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

- Fundamental Strategy Overview: XAUUSD (Gold)

- Understanding the Role of Gold (XAUUSD) as an Inflation Hedge

- How Central Bank Interest Rates Influence Gold Demand

- Gold Holding Trading System

- From Novice to Pro: Navigating the ICT Propulsion Block in Trading

- Single Candle Order Block

Analysts : Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle