Maximize your profit by copy our trade

Understanding Margin Trading in Forex

What is Margin?

Margin in forex trading refers to the amount of money required to open and maintain a position. It is essentially a good faith deposit that allows traders to control a larger position size than their account balance would normally permit.

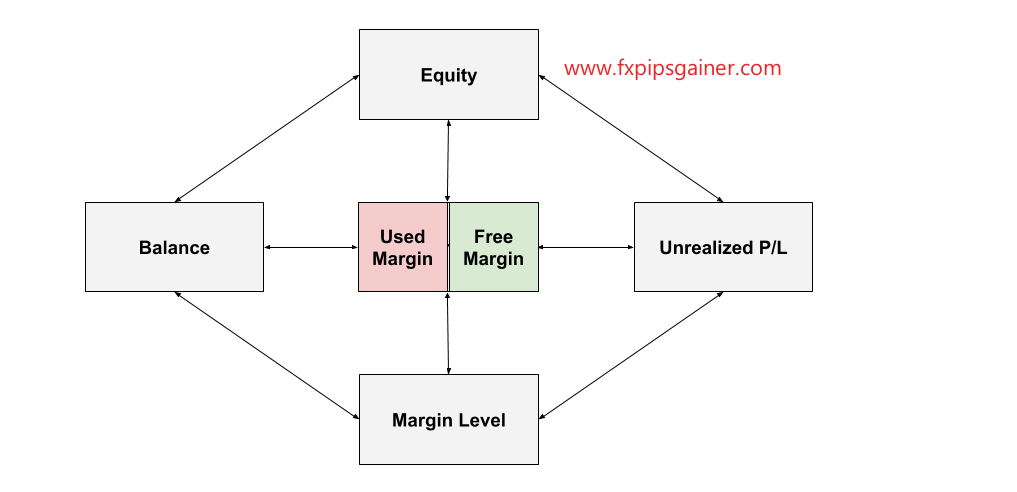

Margin Account Metrics

1. Used Margin

The used margin is the amount of your account balance that is currently being used to maintain your open positions. This is the capital that is “tied up” in your open trades.

2. Free Margin

The free margin is the amount of your account balance that is not being used and is available to open new positions or maintain existing ones. It is calculated as your account balance minus the used margin.

3. Margin Level

The margin level is a percentage that represents the ratio of your equity (account balance) to the used margin. It is calculated as (equity / used margin) x 100. A high margin level indicates you have sufficient funds to maintain your open positions, while a low margin level indicates you are in danger of a margin call.

Maximize your profit by copy our trade

Understanding Margin Trading in Forex

Scenario 1: Buying EUR/USD without Margin

If Peter has a forex trading account with $1,000 and wants to take a position on the EUR/USD currency pair, he can buy 10,000 units (1 standard lot) of EUR/USD without using any margin.

Used Margin = $1,000

Free Margin = $0

Margin Level = 100% ($1,000 / $1,000 x 100)

In this scenario, Peter’s entire account balance is being used to hold the 10,000 unit position.

Scenario 2: Buying EUR/USD with 50:1 Leverage

Now let’s say Peter’s broker offers 50:1 leverage. With this, Peter can open a 10,000 unit position on EUR/USD by only using $20 of his $1,000 account balance as margin.

Used Margin = $20

Free Margin = $980 ($1,000 – $20)

Margin Level = 5,000% ($1,000 / $20 x 100)

In this case, Peter is able to control a 10,000 unit position by only putting up $20 as margin. This gives him 50:1 leverage.

The key takeaways are:

– Margin allows Peter to control a larger position size than his account balance.

– The used margin is the amount of his account being utilized for the open position.

– The free margin is the remaining, unused balance available to open new positions.

– The margin level indicates how much “cushion” Peter has before a margin call.

Understanding these margin concepts is crucial to avoid situations like Peter experiencing a margin call and stop out. Proper margin management is essential for successful forex trading.

4. Margin Call

A margin call occurs when your margin level drops below a certain threshold, typically around 100-120%. This means your used margin is close to or exceeds your account equity. When this happens, your broker will ask you to add more funds to your account to bring your margin level back up.

5. Stop Out or Margin Closeout

If you fail to meet a margin call and your margin level continues to drop, your broker will automatically close out your positions to prevent further losses. This is known as a stop out or margin closeout. Your positions are closed at the current market price, which can result in significant losses.

Let’s say Peter has a forex trading account with $1,000. He decides to take a long position on the EUR/USD currency pair using 50:1 leverage.

Scenario: Buying EUR/USD with 50:1 Leverage

Peter’s Account Balance: $1,000

Leverage: 50:1

Position Size: 10,000 units (1 standard lot) of EUR/USD

Margin Used: $20 (10% of the position size)

In this case, Peter is able to control a 10,000 unit position on EUR/USD by only using $20 of his $1,000 account balance as margin.

Margin Call Level

The margin call level is typically set at 50% by brokers. This means that if Peter’s margin level drops to 50%, he will receive a margin call from his broker.

To calculate the margin call level:

Margin Call Level = 50% of the Used Margin

Margin Call Level = 50% of $20 = $10

This means that if Peter’s unrealized losses cause his free margin to drop to $10 (50% of the $20 used margin), he will receive a margin call from his broker.

Stop Out Level

The stop out level is typically set at 20% by brokers. This means that if Peter’s margin level drops to 20%, his positions will be automatically closed by the broker to prevent further losses.

To calculate the stop out level:

Stop Out Level = 20% of the Used Margin

Stop Out Level = 20% of $20 = $4

This means that if Peter’s unrealized losses cause his free margin to drop to $4 (20% of the $20 used margin), his position will be automatically closed by the broker to prevent further losses.

In this example, if the EUR/USD price moves against Peter’s long position and his free margin drops below $4, his position will be automatically closed, and he will be “stopped out” of the trade.