Maximize your profit by copy Our Trade

Most of us begin by reading about other people’s systems, finding one that appeals to us, and then using it. After a while most of us start tweaking our borrowed systems – until they gradually become as individual as we are. We may remember where our system had originally come from, but by now it has become our own.

Compare this to driving – whether you drive on the right or the left side of the road, or even down the middle of a dirt path in a remote area, your driving style is as personal as your signature. You obey safety rules, but the way you get from A to B reflects your style.

I think that the best place to see other people’s systems is SpikeTrade.com – an online community I co-lead with my friend Kerry Lovvorn. Our members compete for the best stock pick of the week, and as they post their trades, members get to see their systems and can ask them questions.

The following system comes from the section of SpikeTrade called “Q&A with A&K.” That’s where Kerry and I take turns answering members’ questions.

A member from South Carolina wrote: “I don’t have the time to actively manage trades and would be interested in a simple swing trend-following system that I could check at end of each day. What are some suggestions for a system if one exists.”

Kerry replied: “Many of us tend to over-complicate our approaches to the market and lose sight of its basic principles. The difficulty with any trend-following system is the word “follow.” A trend follower must put aside his thoughts and opinions and follow the trend as long as it remains in force.

Maximize your profit by copy Our Trade

“Whenever I build a trading system, I start with a core concept, such as ‘for an uptrend to remain in force, prices must keep making higher lows.’This calls for buying when a potential new uptrend is forming and selling when that trend may be ending. The idea is to catch short-term upswings that last 10 to 20 bars and ride them as long as a stock continues making higher lows.

“Next, let’s define our parameters for buying and selling. We’ll use a variant of a moving average trend-following system, but with a twist: use an EMA of the lows rather than the usual EMA of closing prices.

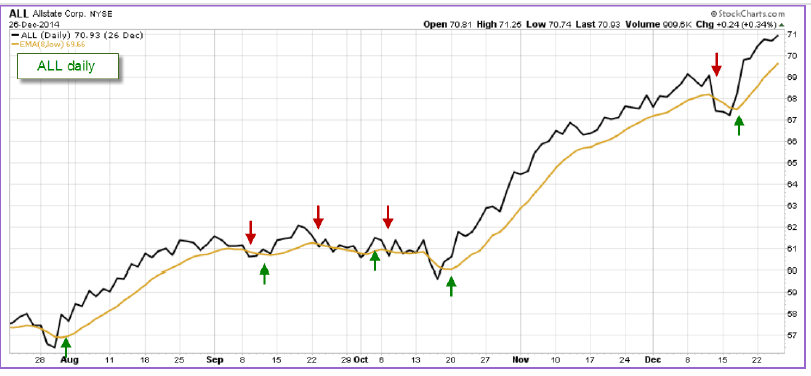

“The black line in the figure above represents closing prices, and the gold line an 8-period average of the lows. Remember: this EMA is based on the lows of each bar instead of its closing ticks. For an uptrend to continue, prices must keep making higher lows.

To create the chart above, follow these steps:

1.) Type “ALL” into the “Create a Chart” box at the top of any of our pages and then click the “Go” button

2.) Find the “ChartStyles” dropdown just underneath the chart that appears

3.) Click on that dropdown and then select “Plain OHLC Bars” from the list that appears

4.) Find the “Type” dropdown located in the “Chart Attributes” area underneath the chart

5.) Click on that dropdown and select “Solid Line (thick)” from the list that appears

6.) Find the empty dropdown in the “Overlays” area located a little lower down the page

7.) Click on that dropdown and select “Exp. Moving Avg.” from the list that appears

8.) Change the “Parameters” box from the default (20) to “8,low”

9.) Change the “Style” from “Auto” to “Solid (thick)”

10.) Change the “Color” from “Auto” to “Gold”

11.) Click the “Update” button to see your chart

“Now let’s set our conditions for buying and selling. Let’s buy when price has traded below its 8-bar EMA of the lows for more than two bars and then closes above that line. Let’s sell when prices close below the 8-bar EMA of the lows, indicating the uptrend is in danger. We may not act until those conditions are met. Buy and sell signals are marked with green and red arrows on the chart above.

“This is a very simple setup with only two rules. We know we will make money as long as prices trend up for more than 10 to 20 bars on average. The next step is to identify suitable stocks to trade using this system. First test it on paper, then with real money, starting with a small size.

“Not all systems are kept to such bare minimums. Many of us tend to complicate our systems before we even validate their basic concept. We may be surprised just how little we need to follow a system to make money.

Hope this helps, Kerry PS…

each person is different which is why any single system will not fit all traders. We must find a system that suits our personality and risk tolerance. If we don’t match our system to the way we are wired, it would be impossible to maintain discipline. I focus on this whenever traders consult with me.”