Maximize your profit by copy our Trade

Retracement Trading: Leveraging Fibonacci Levels

Understanding Retracements and Corrections

Retracements, also known as corrections, refer to a temporary change in the direction of an exchange rate’s overall trend. These are distinct from trend reversals, which have a more lasting impact on the direction of a currency pair. Retracements typically have a shorter timeframe and provide traders with opportunities for short-term profits.

Retracement Trading Strategies

Trend Trading Approach

For trend traders, retracement trading involves waiting for a pullback in a major or intermediate trend to establish positions in the direction of the primary trend. Observing retracements can also help trend traders determine the appropriate level for their stop-loss orders.

Swing Trading Approach

Swing traders, on the other hand, may identify a pending retracement or one in progress and then trade along with it to add to their profits.

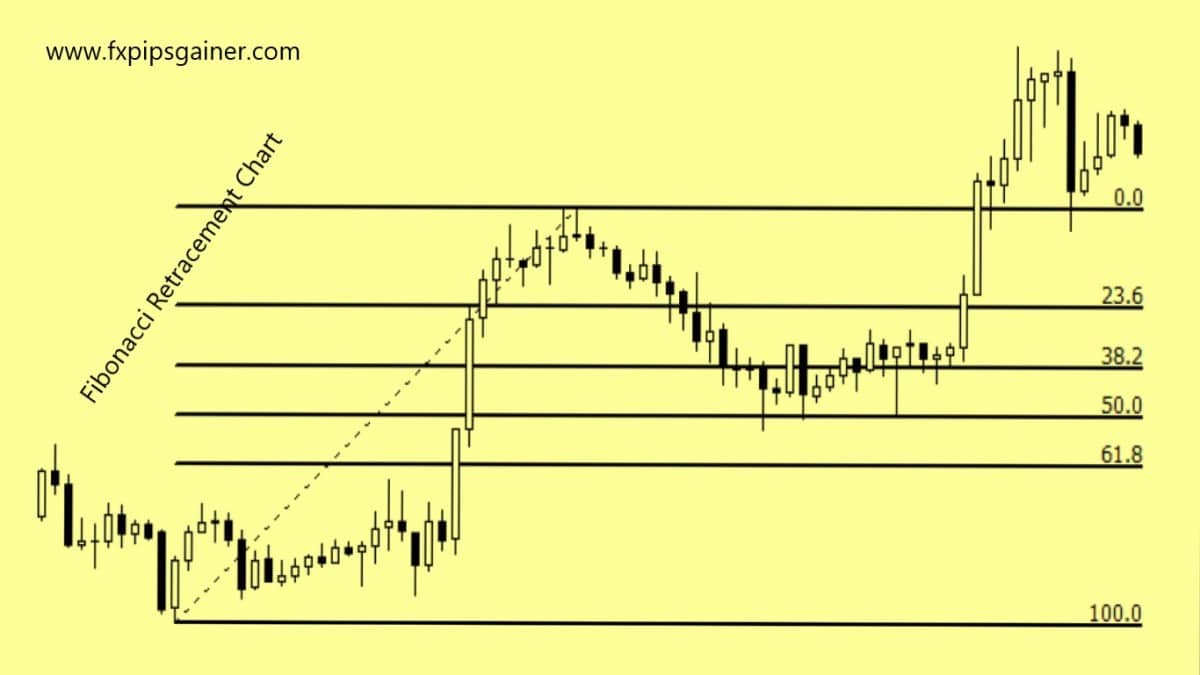

Using Fibonacci Retracement Levels

To better discern support and resistance levels and find retracement trading opportunities, traders often use Fibonacci retracement levels. These levels are calculated based on the high and low points of the preceding trend.

A typical Fibonacci retracement indicator will draw lines at the 0%, 23.6%, 38.2%, 50%, 61.8%, 78.6% (or 76.4%) and 100% retracement levels. Once one Fibonacci retracement level breaks during the correction, the next level in the series becomes the subsequent target.

Example: Identifying Retracement Opportunities in EUR/USD

Suppose EUR/USD experiences a sharp uptrend, rising from 1.1000 to 1.2000 over two weeks, but then enters a declining correction phase. A savvy retracement trader decides to compute the Fibonacci retracement levels of that initial market rise to find potential support zones for the currency pair during its corrective pullbacks.

They calculate the retracement levels by measuring the full extent of the move from 1.1000 to 1.2000 and then multiplying that 0.1000 move by the key Fibonacci retracement percentages and subtracting the result from the peak level of 1.2000 to obtain the relevant horizontal lines.

The trader computes the initial 23.6% retracement level as 1.2000-(0.236*0.1000) = 1.1764, and the subsequent 38.2% retracement level as 1.2000-(0.382*0.1000) = 1.1618.

After breaking below the initial 23.6% retracement level of 1.1764, the trader then goes short with an objective of the market reaching the next 38.2% level of 1.1618. The trader then enters a take-profit order just above this area, with a stop loss safely above 1.1764.

Combining with Momentum Indicators

The use of Fibonacci retracement levels can be combined with momentum indicators like the Relative Strength Index (RSI) to suggest whether a particular Fibonacci level will either break and allow the correction to progress or resist the prior corrective move from continuing.

By incorporating Fibonacci retracement levels and momentum indicators into their trading arsenal, retracement traders can make more informed strategic decisions and capitalize on short-term opportunities within the broader market trends.

Using Fibonacci Levels with Moving Averages

Moving averages are a popular trend-following indicator that can be used in conjunction with Fibonacci levels. Look for the price to pause or reverse at a Fibonacci retracement level that coincides with a key moving average (e.g. 50-period or 200-period SMA). This can provide confirmation of potential support or resistance.

Combining Fibonacci with Oscillators

Oscillators like the Relative Strength Index (RSI), Stochastic, or MACD can help identify overbought or oversold conditions. When the price reaches a Fibonacci retracement level, check the related oscillator reading. Divergences between the price action and the oscillator can signal a potential reversal at that Fibonacci level.

Applying Fibonacci with Volume Analysis

Volume patterns can also be used to validate Fibonacci retracement levels. Look for increased volume around the Fibonacci levels, as this can indicate stronger support or resistance. A drop in volume at a Fibonacci level could signal a potential breakout.

Incorporating Fibonacci with Candlestick Patterns

Candlestick patterns like engulfing, pin bars, or doji can provide additional confirmation when the price reaches a key Fibonacci retracement level. The candlestick pattern can signal a potential reversal or continuation of the trend at that support/resistance level.

Example: Combining Fibonacci, Moving Averages, and RSI

Let’s say you’re analyzing the EUR/USD chart and notice the price has pulled back to the 38.2% Fibonacci retracement level after a strong uptrend. You also see that this Fibonacci level coincides with the 50-period simple moving average (SMA).

To confirm a potential support level, you check the Relative Strength Index (RSI). If the RSI is in oversold territory (below 30) while the price is at the 38.2% Fibonacci level and 50-period SMA, this could be a valuable confluence of signals to consider going long with a protective stop-loss order just below the Fibonacci level.

By layering various technical indicators with the Fibonacci retracement analysis, you can identify higher-probability trading opportunities and manage your risk more effectively. The key is to find complementary indicators that provide confirmations at the Fibonacci levels.

Trending Markets

In strong, established trends, the standard Fibonacci retracement levels of 23.6%, 38.2%, 50%, and 61.8% tend to be the most useful. These levels often act as support or resistance during pullbacks within the primary trend. The 23.6% and 38.2% levels are commonly used entry points for trend continuation trades.

Ranging/Consolidating Markets

In sideways, range-bound markets, the 50% Fibonacci level becomes more significant, as it often acts as the midpoint of the trading range. Traders may also pay closer attention to the 38.2% and 61.8% levels, as they can mark the boundaries of the range.

Volatile/Choppy Markets

In highly volatile or choppy market conditions, the 23.6% and 38.2% Fibonacci levels may be less reliable as support/resistance. In these cases, traders may focus more on the 50% and 61.8% levels, as they can provide clearer areas of potential support or resistance.

Identifying the Relevant Timeframe

The significance of Fibonacci levels can also vary depending on the timeframe being analyzed. For example, on a daily chart, the 23.6% and 38.2% levels may be more useful, while on an hourly or 15-minute chart, the 50% and 61.8% levels may be more prominent.

Combining with Other Indicators

As mentioned earlier, it’s often beneficial to combine Fibonacci analysis with other technical indicators, such as moving averages, momentum oscillators, and candlestick patterns. This can help confirm the significance of a particular Fibonacci level and increase the reliability of your trade setups.

Example: Adapting Fibonacci Levels in a Ranging Market

Let’s say you’re analyzing the GBP/USD currency pair, and the market has been in a sideways consolidation pattern for several weeks. In this scenario, you might place more emphasis on the 50% Fibonacci retracement level, as it is likely to act as a key support or resistance area.

You might also pay close attention to the 38.2% and 61.8% levels, as they could mark the upper and lower boundaries of the trading range. By identifying these key Fibonacci levels and combining them with other technical analysis, you can develop a more comprehensive understanding of the current market conditions and make more informed trading decisions.

The key is to remain adaptable and adjust your focus on the Fibonacci levels based on the prevailing market environment. This will help you identify the most relevant retracement levels and improve the effectiveness of your trading strategies.

Identify the Relevant Moving Averages

The most commonly used moving averages for Fibonacci analysis are the 50-period and 200-period simple moving averages (SMAs). These longer-term averages can provide important support and resistance levels, especially when combined with Fibonacci retracement levels.

Confluence of Fibonacci and Moving Averages

Look for instances where the price interacts with a Fibonacci retracement level that also aligns with a key moving average. For example, if the price pulls back to the 38.2% Fibonacci retracement level and this level also coincides with the 50-period SMA, it can indicate a significant support or resistance area that is worth paying attention to.

Trending Markets

In a strong uptrend, the price may pull back to the 23.6% or 38.2% Fibonacci retracement levels, which could also align with the 50-period SMA, providing a potential buying opportunity. Conversely, in a downtrend, the 61.8% or 76.4% Fibonacci levels combined with the 200-period SMA could signal areas of resistance.

Range-Bound Markets

In sideways, range-bound markets, the 50% Fibonacci retracement level is often significant, especially when it coincides with the 50-period or 200-period SMA. These moving average-Fibonacci confluences can help identify the upper and lower boundaries of the trading range.

Confirmation of Trend Reversals

When the price breaks above or below a Fibonacci retracement level that is also aligned with a moving average, it can provide a stronger signal of a potential trend reversal. For example, if the price breaks above the 38.2% Fibonacci level and the 50-period SMA, it could indicate the start of a new uptrend.

Example: Combining Fibonacci and Moving Averages

Let’s say you’re analyzing the EUR/USD chart and notice the price has pulled back to the 38.2% Fibonacci retracement level after a sustained uptrend. You also observe that this Fibonacci level coincides with the 50-period SMA.

In this scenario, the confluence of the 38.2% Fibonacci level and the 50-period SMA could be a significant support area. If the price starts to bounce off this level, with the 50-period SMA providing additional support, it could be a good opportunity to enter a long position, with a stop-loss order placed just below the Fibonacci and moving average levels.

By combining Fibonacci retracement levels with relevant moving averages, you can identify high-probability trading opportunities, confirm trends and potential reversals, and manage your risk more effectively. This approach can be especially useful in trending and range-bound market conditions.

Common Mistakes When Using Fibonacci and Moving Averages

When using a strategy that combines Fibonacci retracement levels with moving averages, there are a few common mistakes that traders should be aware of:

1. Overreliance on Fibonacci Levels

While Fibonacci levels can provide important support and resistance areas, they should not be the sole basis for trading decisions. Traders need to consider the broader market context, including other technical indicators, chart patterns, and fundamental factors.

2. Incorrect Fibonacci Calculation

Accurately calculating Fibonacci retracement levels is crucial. Traders should ensure they are using the correct swing highs and lows to determine the Fibonacci levels, as even minor errors can lead to inaccurate levels and poor trading decisions.

3. Ignoring Market Conditions

The significance of Fibonacci levels and their interaction with moving averages can vary depending on the prevailing market conditions. Traders should be adaptable and adjust their approach based on whether the market is trending, ranging, or volatile.

4. Failing to Confluence with Other Indicators

Relying solely on the combination of Fibonacci levels and moving averages can be risky. Traders should strive to confluence this approach with other technical indicators, such as oscillators, volume analysis, and candlestick patterns, to increase the reliability of their trading signals.

5. Inconsistent Time Frame Analysis

Traders may make the mistake of analyzing Fibonacci levels and moving averages on different time frames, leading to conflicting signals and confusion. It’s important to align the time frames used for Fibonacci analysis and moving average analysis to ensure cohesive decision-making.

6. Lack of Risk Management

Even with a well-planned strategy, traders can still make the mistake of not implementing proper risk management techniques, such as setting appropriate stop-loss levels and position sizing. This can lead to outsized losses and undermine the effectiveness of the Fibonacci-moving average approach.

7. Overoptimization

Some traders may fall into the trap of over-optimizing their Fibonacci and moving average parameters for historical performance, rather than focusing on developing a robust, adaptable strategy that can perform well across different market conditions.

To avoid these common pitfalls, traders should strive to maintain a balanced and disciplined approach when combining Fibonacci retracement levels with moving averages. Continuously reviewing their strategy, monitoring market conditions, and incorporating other technical and fundamental analysis can help traders make the most of this powerful analytical tool.

Effective Risk Management Techniques for Trading with Fibonacci and Moving Averages

When using a trading strategy that combines Fibonacci retracement levels and moving averages, effective risk management is crucial. Here are some key risk management techniques to consider:

1. Position Sizing

- Determine an appropriate position size based on your account size and risk tolerance.

- Use the 1% rule or a similar risk-based approach to limit your risk per trade.

- Adjust position sizes based on market volatility and the strength of your trading signals.

2. Stop-Loss Orders

- Place stop-loss orders below key Fibonacci support levels or below the moving average(s) you’re using.

- Set stop-loss levels that account for market volatility and allow for normal price fluctuations.

- Consider using trailing stop-loss orders to protect profits as the trade progresses.

3. Diversification

- Diversify your portfolio by trading multiple currency pairs, commodities, or other asset classes.

- Avoid over-concentration in any single trade or market.

- Ensure that your Fibonacci and moving average trades are not highly correlated with your other positions.

4. Trade Management

- Monitor your trades closely and be prepared to adjust your position or exit the trade if the market conditions change.

- Use scale-in or scale-out strategies to manage your risk and potentially increase your profits.

- Be disciplined and follow your trading plan – do not let emotions or impulses override your risk management rules.

5. Backtesting and Paper Trading

- Thoroughly backtest your Fibonacci and moving average strategy to understand its historical performance and risk/reward profile.

- Paper trade your strategy in a live market environment to refine your execution and risk management skills before risking real capital.

- Continuously evaluate and optimize your strategy based on your backtesting and paper trading results.

6. Trade Sizing and Leverage

- Avoid over-leveraging your trades, as this can amplify your losses and increase your risk exposure.

- Adjust your trade size based on the volatility of the market and the strength of your trading signals.

- Consider using a lower leverage ratio, especially when the market is exhibiting high volatility.

7. Automated Risk Management

- Utilize software or brokers that offer automated risk management features, such as trailing stop-loss orders or take-profit levels.

- Integrate your Fibonacci and moving average strategy with these automated risk management tools to help ensure consistent execution.

By implementing these risk management techniques, traders can effectively manage their exposure and protect their capital when using a Fibonacci and moving average trading strategy. Consistent risk management is essential for long-term trading success, regardless of the specific indicators or tools being employed.

Common Mistakes Traders Make with Fibonacci Retracement Levels

1. Overreliance on Fibonacci Levels

Treating Fibonacci levels as infallible and the sole basis for trading decisions. Fibonacci retracements should be used in conjunction with other technical and fundamental analysis tools.

2. Incorrect Fibonacci Level Placement

Incorrectly identifying the swing highs and lows used to draw the Fibonacci retracement levels, leading to inaccurate support and resistance levels.

3. Failure to Adjust for Market Conditions

Not adjusting Fibonacci levels to account for changes in market volatility, trend strength, and other dynamic market factors.

4. Ignoring Support and Resistance Levels

Focusing solely on Fibonacci levels and disregarding other potential support and resistance areas in the market.

5. Lack of Trade Management

Failing to properly manage trades using stop-loss orders, position sizing, and other risk management techniques around Fibonacci levels.

6. Confirmation Bias

Selectively interpreting Fibonacci levels to confirm existing biases and trading positions, rather than objectively evaluating the market conditions.

7. Lack of Backtesting and Optimization

Not thoroughly backtesting Fibonacci-based trading strategies to understand their historical performance and optimize the strategy parameters.

By being aware of these common mistakes and incorporating Fibonacci retracements as one of many analytical tools, traders can improve their decision-making and risk management when using this technical indicator.

How to Correctly Draw Fibonacci Retracement Levels

- Identify the Swing High and Swing Low: Determine the most recent significant swing high and swing low in the price action. These will be the starting and ending points for the Fibonacci retracement levels.

- Draw the Fibonacci Retracement Tool: In your trading platform, select the Fibonacci retracement tool and click on the swing low, then drag the tool to the swing high. This will draw the Fibonacci retracement levels on the chart.

- Confirm the Fibonacci Levels: Ensure that the Fibonacci retracement levels are drawn correctly, with the 0% level at the swing low and the 100% level at the swing high. The standard Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 76.4%.

- Adjust for Market Conditions: Consider adjusting the Fibonacci levels to better fit the current market environment. For example, in a strong trending market, the 38.2% and 61.8% levels may be more relevant than the 50% level.

- Combine with Other Technical Indicators: Use the Fibonacci retracement levels in conjunction with other technical analysis tools, such as moving averages, support and resistance levels, and momentum indicators, to enhance your trading decisions.

- Monitor and Adjust: Continuously monitor the price action and be prepared to adjust the Fibonacci retracement levels as the market conditions change. Levels that were previously significant support or resistance may become less relevant over time.

By following these steps, you can correctly draw and interpret Fibonacci retracement levels to improve your trading decisions and risk management strategies.

Identifying the Best Fibonacci Retracement Levels for Different Market Conditions

Strong Uptrend

- Focus on the 38.2% and 61.8% Fibonacci retracement levels as these often act as strong support during pullbacks.

- The 23.6% level can also be relevant, as it may signal a shallower retracement before the uptrend resumes.

- The 50% level may be less significant in a strong uptrend, as the market is more likely to find support at the higher Fibonacci levels.

Strong Downtrend

- The 38.2% and 61.8% Fibonacci retracement levels can act as resistance during bounces in a strong downtrend.

- The 76.4% level may also be an important resistance level, as the market often struggles to break above this level in a strong downtrend.

- The 50% level can be a key resistance area, as the market may find it difficult to overcome this midpoint retracement.

Ranging Market

- In a ranging market, all Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8%, and 76.4%) can be significant support and resistance areas.

- The market may oscillate between these levels, providing trading opportunities at each retracement.

- Pay attention to the overall market context, as a ranging market can transition into a trend at any time.

Key Considerations

- Combine Fibonacci retracements with other technical indicators and market analysis to confirm support and resistance levels.

- Be aware that Fibonacci levels can act as dynamic support and resistance, adjusting to changes in market volatility and momentum.

- Always use proper risk management and position sizing when trading based on Fibonacci retracement levels.

By understanding how the market typically reacts at different Fibonacci retracement levels in various market conditions, you can improve your trading strategy and decision-making process.

Using RSI with Fibonacci Retracement Levels

Identifying Support and Resistance Levels

- Draw the Fibonacci retracement levels on your chart, as discussed earlier.

- Overlay the RSI indicator on the same chart to analyze the relationship between price action and momentum.

- Look for instances where the price bounces off a Fibonacci retracement level, and observe the corresponding RSI level.

- The Fibonacci retracement levels that coincide with RSI support or resistance are more likely to be significant support or resistance areas for the price.

Confirming Trend Strength and Potential Reversals

- In a strong uptrend, look for the price to retrace to the 38.2% or 61.8% Fibonacci level while the RSI remains in the overbought region (above 70).

- This can confirm the underlying strength of the uptrend and provide an opportunity to enter a long position at a retracement level.

- Conversely, in a strong downtrend, look for the price to bounce off the 38.2% or 61.8% Fibonacci level while the RSI is in the oversold region (below 30).

- This can signal a potential reversal and an opportunity to enter a short position at a retracement level.

Divergence Analysis

- Look for divergences between the price action and the RSI indicator at the Fibonacci retracement levels.

- For example, if the price makes a higher high but the RSI makes a lower high, it may indicate a potential bearish reversal at the Fibonacci level.

- Conversely, if the price makes a lower low but the RSI makes a higher low, it may signal a potential bullish reversal at the Fibonacci level.

Key Considerations

- Combine the RSI and Fibonacci retracement analysis with other technical and fundamental factors to improve the reliability of your trading decisions.

- Be mindful of market conditions and adjust your analysis accordingly, as the significance of Fibonacci levels and RSI levels can vary in different market environments.

- Always use appropriate risk management techniques, such as stop-loss orders and position sizing, when trading based on these combined analyses.

By integrating RSI and Fibonacci retracement levels, you can gain a more comprehensive understanding of the market’s momentum and potential support and resistance areas, which can lead to more informed and profitable trading decisions.

Recent Posts

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

- Fundamental Strategy Overview: XAUUSD (Gold)

- Understanding the Role of Gold (XAUUSD) as an Inflation Hedge

- How Central Bank Interest Rates Influence Gold Demand

- Gold Holding Trading System

- From Novice to Pro: Navigating the ICT Propulsion Block in Trading

- Single Candle Order Block

- Is Scalping Right for You? Understanding the Advantages and Disadvantages

- The Dangers of Screenshot Trading: What You Need to Know

- Guidance for New Traders in Forex

- Forex Signal

- Understanding Market Psychology in Trading

- The Power of Order Blocks: Key Concepts Every Trader Should Know

- Understanding Imbalance and Fair Value Gaps (FVG)

- External and Internal Structure

- Causes of Market Pullbacks: What Every Investor Should Know

- Highs and Lows in Financial Markets: Key Concepts for Traders

- The Definitive Supply and Demand Trading Guide for Forex Traders

- Trading the Hanging Man with Pivot Points

- Trading the Hanging Man with Fibonacci Retracement

- Navigating Perfect Money: Pros and Cons You Need to Know

- Mastering the Super Signal Strategy with Donchian Channels

- Why Many Traders Lose in Forex: A Focus on Gold (XAU/USD)

- Beware of Forex Market Manipulation: Essential Insights for Traders

- Trading the Hanging Man with RSI Divergences

- The Forex Trader’s Blueprint: Understanding Supply and Demand Dynamics

- Trading the Hanging Man with Moving Averages

- Hanging Man Candlesticks Pattern

- Smart Money Concept(SMC) in Forex Market

- Advantages of Exness Forex Broker

- Trading the Hanging Man with Resistance Levels

- Bullish Harami Candlesticks Pattern

- Scalping Trading Strategy

- Trading with Confidence: A Closer Look at HFM Broker

- Swing Trading Strategy

- Breakout Trading Strategy

- XM Forex Broker: Your Gateway to Successful Trading