Maximize your profit by copy Our Trade

Mastering the Single Candle Order Block (SCOB) Trading Strategy

If you’re looking to level up your trading skills, mastering the Single Candle Order Block (SCOB) strategy can significantly enhance your market predictions. This guide will break down the concept step-by-step, providing clear definitions, examples, and strategies for both bullish and bearish scenarios.

What is a Single Candle Order Block?

A Single Candle Order Block (SCOB) is a specific candlestick pattern that appears at significant price levels, indicating a potential reversal in price direction. It serves as a confirmation point for trade entries, enabling traders to minimize risk while maximizing reward.

Step-by-Step Breakdown

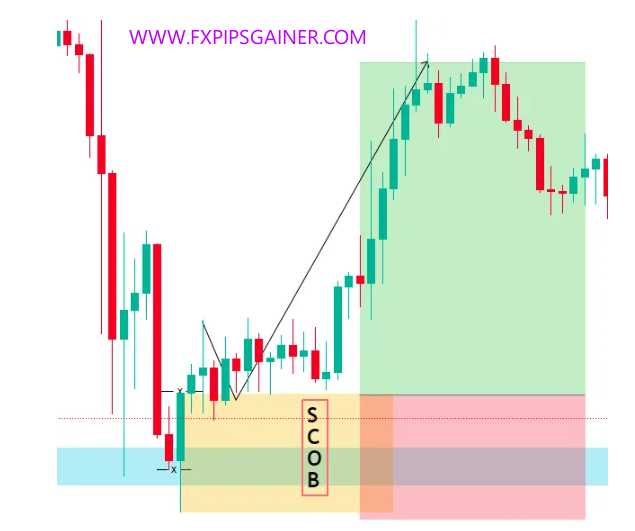

1. Understanding the Bullish Single Candle Order Block

Definition

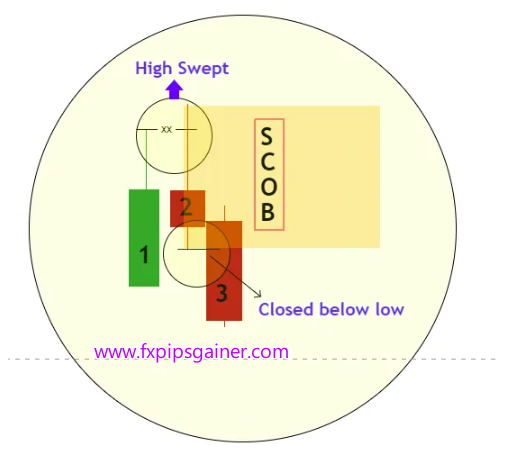

A Bullish SCOB occurs at bullish points of interest, such as fair value gaps, order blocks, or breaker blocks. It signals that buyers are stepping in and price may rise.

Identification Criteria

To identify a bullish SCOB, follow these steps:

- First Candle: Closes at a bullish point of interest with a short or long wick.

- Second Candle: Sweeps below the low of the first candle and then closes above the low of the first candle.

- Third Candle: Closes above the high of the second candle.

Once these criteria are met, the middle candle (the second one) is marked as the Bullish Single Candle Order Block.

Example

Imagine the following price action on an XAUUSD (Gold) chart:

- 1st Candle: Closes at $1,800 with a long wick.

- 2nd Candle: Dips to $1,795 (low of the first candle) but closes at $1,802.

- 3rd Candle: Closes at $1,805.

This confirms the bullish SCOB at $1,800.

Trading Strategy

- Wait for the price to retrace to the SCOB level (e.g., $1,800).

- Execute a buy trade once the price tests the SCOB.

- Set a stop loss 10-20 pips below the low of the SCOB (around $1,795).

2. Understanding the Bearish Single Candle Order Block

Definition

A Bearish SCOB occurs at bearish points of interest (e.g., fair value gaps, order blocks, breaker blocks) and indicates that sellers are likely to step in, causing prices to drop.

Identification Criteria

To spot a bearish SCOB, follow these steps:

- First Candle: Closes at a bearish point of interest with either a short or long wick.

- Second Candle: Surpasses the high of the first candle but closes below the high of the first candle.

- Third Candle: Closes below the low of the second candle.

Once these criteria are confirmed, the middle candle (the second one) is marked as the Bearish Single Candle Order Block.

Example

Consider the following price action on an XAUUSD chart:

- 1st Candle: Closes at $1,810 with a long wick.

- 2nd Candle: Surpasses $1,810, reaching $1,815 but closes at $1,808.

- 3rd Candle: Closes at $1,805.

This confirms the bearish SCOB at $1,810.

Trading Strategy

- Wait for the price to retrace to the SCOB level (e.g., $1,810).

- Execute a sell trade once the price tests the SCOB.

- Set a stop loss 10-20 pips above the high of the SCOB (around $1,815).

Final Thoughts

While the Single Candle Order Block strategy can be effective, remember that no trading strategy is foolproof. It’s crucial to manage your risks by using stop-loss orders and not risking your entire capital on a single trade. By understanding and applying the SCOB strategy, you can better navigate market movements and make informed trading decisions. Happy trading!

Trade Now

Recent Posts

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

- Fundamental Strategy Overview: XAUUSD (Gold)

- Understanding the Role of Gold (XAUUSD) as an Inflation Hedge

- How Central Bank Interest Rates Influence Gold Demand

- Gold Holding Trading System

- From Novice to Pro: Navigating the ICT Propulsion Block in Trading

- Single Candle Order Block

- Is Scalping Right for You? Understanding the Advantages and Disadvantages

- The Dangers of Screenshot Trading: What You Need to Know

- Guidance for New Traders in Forex

- Forex Signal

- Understanding Market Psychology in Trading

- The Power of Order Blocks: Key Concepts Every Trader Should Know

- Understanding Imbalance and Fair Value Gaps (FVG)

- External and Internal Structure

- Causes of Market Pullbacks: What Every Investor Should Know

- Highs and Lows in Financial Markets: Key Concepts for Traders

- The Definitive Supply and Demand Trading Guide for Forex Traders

- Trading the Hanging Man with Pivot Points

- Trading the Hanging Man with Fibonacci Retracement

- Navigating Perfect Money: Pros and Cons You Need to Know

- Mastering the Super Signal Strategy with Donchian Channels

- Why Many Traders Lose in Forex: A Focus on Gold (XAU/USD)

- Beware of Forex Market Manipulation: Essential Insights for Traders

- Trading the Hanging Man with RSI Divergences

- The Forex Trader’s Blueprint: Understanding Supply and Demand Dynamics

- Trading the Hanging Man with Moving Averages

- Hanging Man Candlesticks Pattern

- Smart Money Concept(SMC) in Forex Market

- Advantages of Exness Forex Broker

- Trading the Hanging Man with Resistance Levels

- Bullish Harami Candlesticks Pattern

- Scalping Trading Strategy

- Trading with Confidence: A Closer Look at HFM Broker

- Swing Trading Strategy

- Breakout Trading Strategy

- XM Forex Broker: Your Gateway to Successful Trading