Maximize your profit by copy our Trade

Are you an ICT trader looking to master the ICT Propulsion Block to increase your winning ratio? This guide will walk you through the identification and trading of ICT Propulsion Blocks, complete with real market examples. With thorough study and practice, you’ll be able to identify and trade the ICT Propulsion Block like a pro.

What is the ICT Propulsion Block?

The term propulsion means to push something. In trading, it refers to a single candlestick that pushes the price away from it. An ICT Propulsion Block is defined as the single candlestick that trades into an Order Block, followed by a significant price movement away from it.

When the price revisits the propulsion candle, it typically reacts quickly, resulting in sudden price movements that can be utilized for trading.

Types of ICT Propulsion Blocks

1. Bullish ICT Propulsion Block

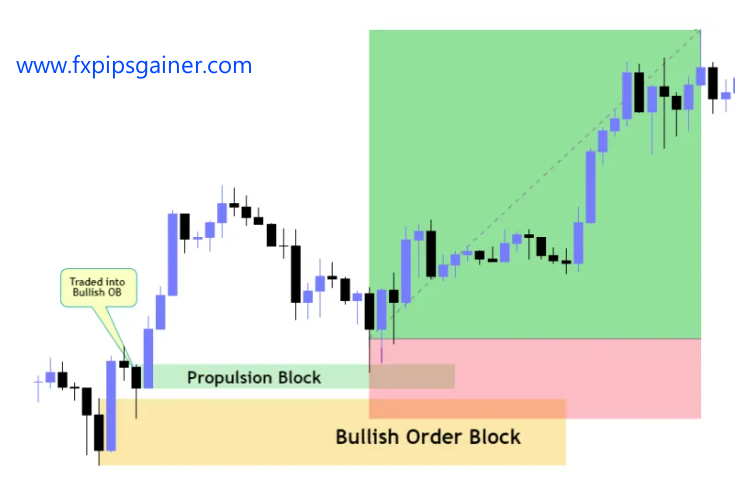

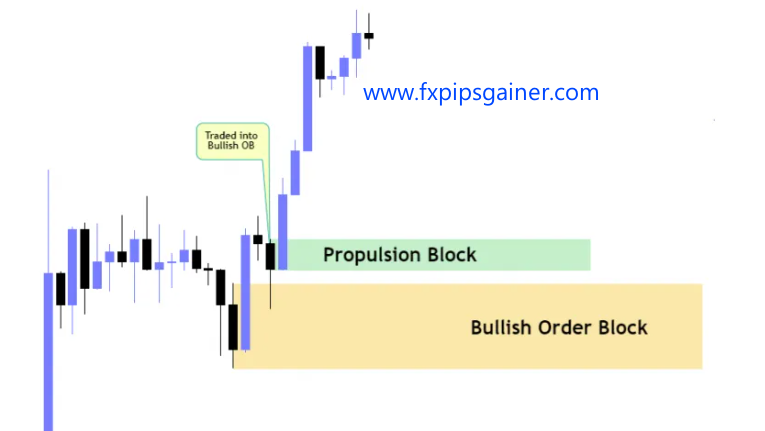

A Bullish ICT Propulsion Block is the last bearish candlestick that trades into a bullish Order Block before the price moves upward. When the price retraces, it tends to find support at the propulsion candlestick, leading to a quick upward movement.

How to Trade a Bullish ICT Propulsion Block

- Identify the Propulsion Candle: Look for the last bearish candle that led to a bullish movement.

- Determine the Mean Threshold:

- Wait for Price to Retrace: Look for the price to return to the propulsion candle.

- Execute Buy Trade:

- Buy when the price approaches the body of the propulsion candlestick above the mean threshold.

- Set Stop Loss: Place it 10 pips below the low of the propulsion candlestick.

- Set Take Profit: Target the next buy-side liquidity levels or use ICT Fibonacci levels.

2. Bearish ICT Propulsion Block

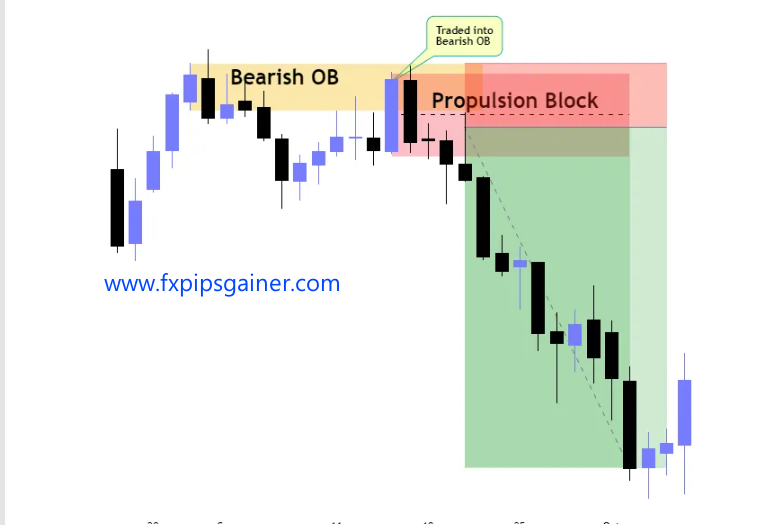

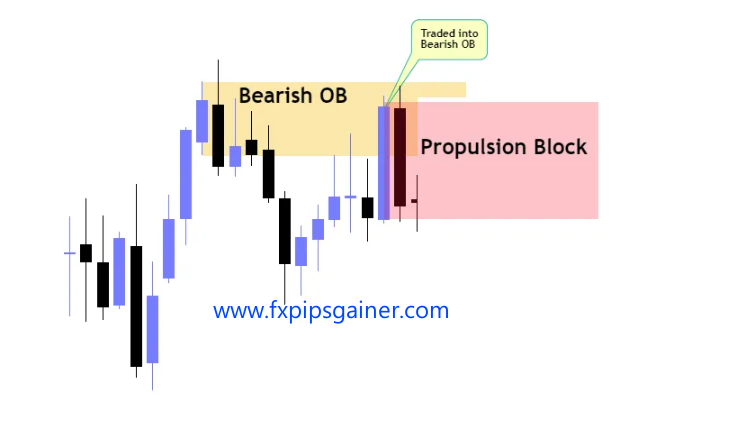

A Bearish ICT Propulsion Block is the last bullish candlestick that trades into a bearish Order Block before the price moves downward. When the price retraces, it tends to encounter resistance at the propulsion candlestick, leading to a quick downward movement.

How to Trade a Bearish ICT Propulsion Block

- Identify the Propulsion Candle: Look for the last bullish candle that led to a bearish movement.

Trade Now

- Determine the Mean Threshold:

- Wait for Price to Retrace: Look for the price to return to the propulsion candle.

- Execute Sell Trade:

- Sell when the price approaches the body of the propulsion candlestick below the mean threshold.

- Set Stop Loss: Place it 10 pips above the high of the propulsion candlestick.

- Set Take Profit: Target the next sell-side liquidity levels or use ICT Fibonacci levels.

Is the ICT Propulsion Block Reliable for Trading?

Yes, the ICT Propulsion Block is considered reliable due to its accuracy and the potential for a small stop loss, which can lead to a high reward-to-risk ratio.

Can We Trade Using the Propulsion Block Alone?

Yes, you can trade using the Propulsion Block independently. However, it is crucial to have a correct daily bias to trade accurately.

Can We Use the Propulsion Block for Scalping?

Absolutely! The Propulsion Block can be used for scalping, day trading, or swing trading. The primary difference lies in the timeframe you choose for identifying and utilizing the Propulsion Block:

- Scalping: Use smaller timeframes (e.g., M1, M3, M5).

- Day Trading: Use medium timeframes (e.g., M30, 1H, 4H).

By mastering the ICT Propulsion Block, you can significantly enhance your trading strategy. Follow the steps outlined in this guide, practice in the market, and you’ll be well on your way to executing trades with confidence and precision. Happy trading!

Recent Posts

- What is a Cent Account?

- Smart Money Concepts: Mastering Mitigation Blocks, Breaker Blocks & QML

- Understanding ICT Reclaimed Order Blocks: How Institutions Control Market Moves

- How to Trade Consolidations in Forex and Other Markets

- How to Identify Real Forex Traders vs Fake Screenshot Gurus

- The Gold Accumulation System – A Safe Buy-Only Strategy for Cent Accounts

- The Dark Side of Forex: How Screenshot Scammers Trap New Traders

- CHOCH vs MSS: The Exact Difference Every Smart Money Trader Must Know

- Gold Buy-and-Hold Strategy Using Cent Account and Compounding Lot Size (No SL Trading Model)

- How to Trade Order Flow Imbalances: Simple Rules for Spotting Buy & Sell Order Blocks

- Copy Our Long-Term Gold Trading Strategy

- Execution Mode vs Outcome Mode — The Professional Approach to Managing Trades

- How I Achieved 80.95% Profit in One Year on HFM Copy Trading

- Why It Took Me 15 Years to Become a Profitable Trader

- How to Read and Interpret Profit Factor in Forex Backtesting

- Understanding the Institutional Accumulation Channel

- Understanding No-Deposit Bonuses in Forex: What You Need to Know

- XAUUSD Analysis Summary

- Gold Price Surge Summary

- XAU/USD(GOLD) Analysis 07/10/2025

- Gold Market Update 07/10/2025

- Gold(XAUUSD) Market analysis 07/10/2025

- Start your journey to Forex success

- আপনার ফরেক্স সফলতার যাত্রা শুরু করুন

- 7 Money Rules for Financial Awareness and Peace of Mind

- Gold Recovers Ahead of Nonfarm Payrolls: Key Insights

- Weekly Market Wrap: Gold Pulls Back Amid Dollar and Bond Rotation

- Copy Our Trade with OneRoyal

- Finding Your Path: How to Choose the Perfect Forex Mentor for Success

- Experience the Stability of a 100% Secure Trading Account!

- The 100% Profitable Trading Approach: Maximize Gains with Minimal Risk

- The Head and Shoulders Chart Pattern

- Bullish and Bearish Rejection Blocks: Identifying Key Trading Opportunities

- Just Market: Is It Worth Your Time and Money?

- Why LiteFinance Stands Out: A Comprehensive Review

- Understanding XAUUSD: Gold Strategy and Central Bank Reserve Management

- Hotforex Copy Trading Service

- Understanding Profit Factor: A Key Metric for Trading Success

- Supply and Demand Dynamics: How Gold Production Affects XAUUSD

- The Safe Haven: Gold as a Strategic Investment During Economic Downturns

- Mastering Deception: How to Scam as a Forex Signal Provider

- The Impact of Rising Bond Yields on Gold (XAUUSD)

- Understanding the Correlation Between Oil Prices and Gold (XAUUSD)

- The Impact of Geopolitical Events on Gold Demand (XAUUSD)

- Fundamental Strategy Overview: XAUUSD (Gold)

- Understanding the Role of Gold (XAUUSD) as an Inflation Hedge

- How Central Bank Interest Rates Influence Gold Demand

- Gold Holding Trading System

- From Novice to Pro: Navigating the ICT Propulsion Block in Trading

- Single Candle Order Block